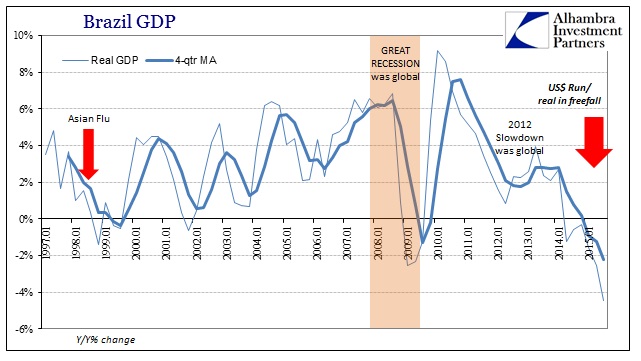

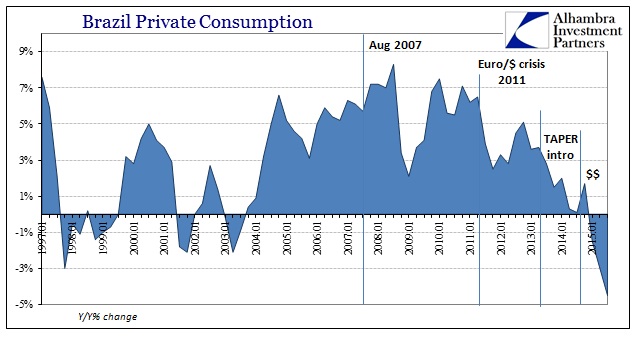

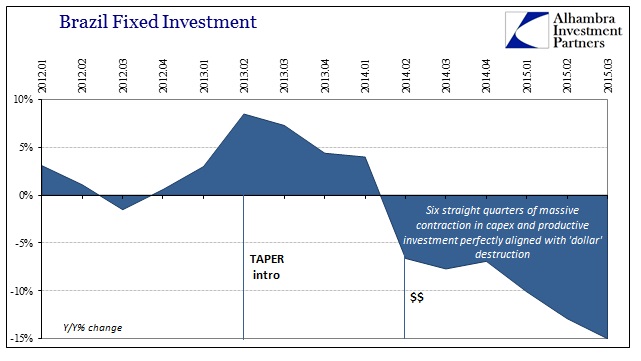

The GDP statistics for Brazil as of Q3 2015 were worse than expected in every way imaginable. Real GDP fell 4.5% Y/Y, which is nearly double the worst quarter Brazil experienced during the Great Recession. Household spending fell 1.7%, the third consecutive quarter of contraction, while fixed investment declined an astounding 15%. That was the sixth straight reduction and the third in a row worse than -10%. Private consumption fell by 4.5%, by far the worst since Brazil’s tumultuous 1990’s.

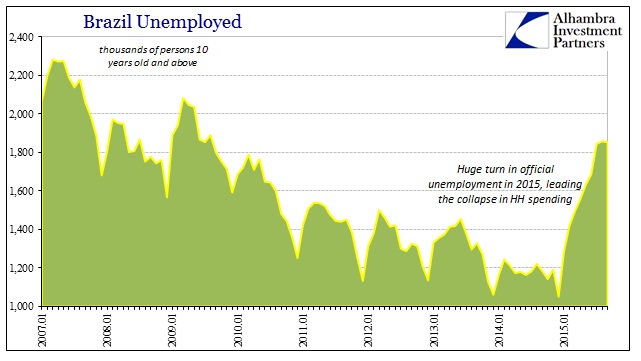

There was no silver lining anywhere, as the country struggles still with unmanageable imbalances. Unlike the Great Recession, this time the South American nation has seen (in official statistics) a surge even in the official count of unemployed. IBGE reported just 1.05 million unemployed at the end of 2014, but 1.85 million in September. That reverses a fifteen year trend that wasn’t much disturbed even by the Great Recession. In other words, if the ongoing dislocation is showing up even in the official rolls of the unemployed, and at an 80% increase, then the economic situation is beyond dire and threatening toward pure chaos.

That all of this would align so closely to the global eurodollar condition isn’t surprising, it is simple math. Brazil’s “prosperity” was founded on the same myth as China’s (and the US bubble conditions). It is difficult to parse what is organic “demand” and even “supply” in Brazil, meaning that there is no indication as to how far the system might have to just implode in order to unpack and separate its basic condition from the artificial introductions of “dollar” financialism. Like the rest of the world, Brazil is finding out the nature of the eurodollar on the downslope.

This is all just financialism stripped of ongoing monetary expansion; in this case, the wholesale “dollar” expansion that carried global and US growth (more in the former than the latter) for more than a decade. Brazil and China “emerged” in the 2000’s on that monetary influence, which is highly visible any place you actually look. The distortion in the Chinese economy is just as striking (data below taken from the Atlanta Fed).