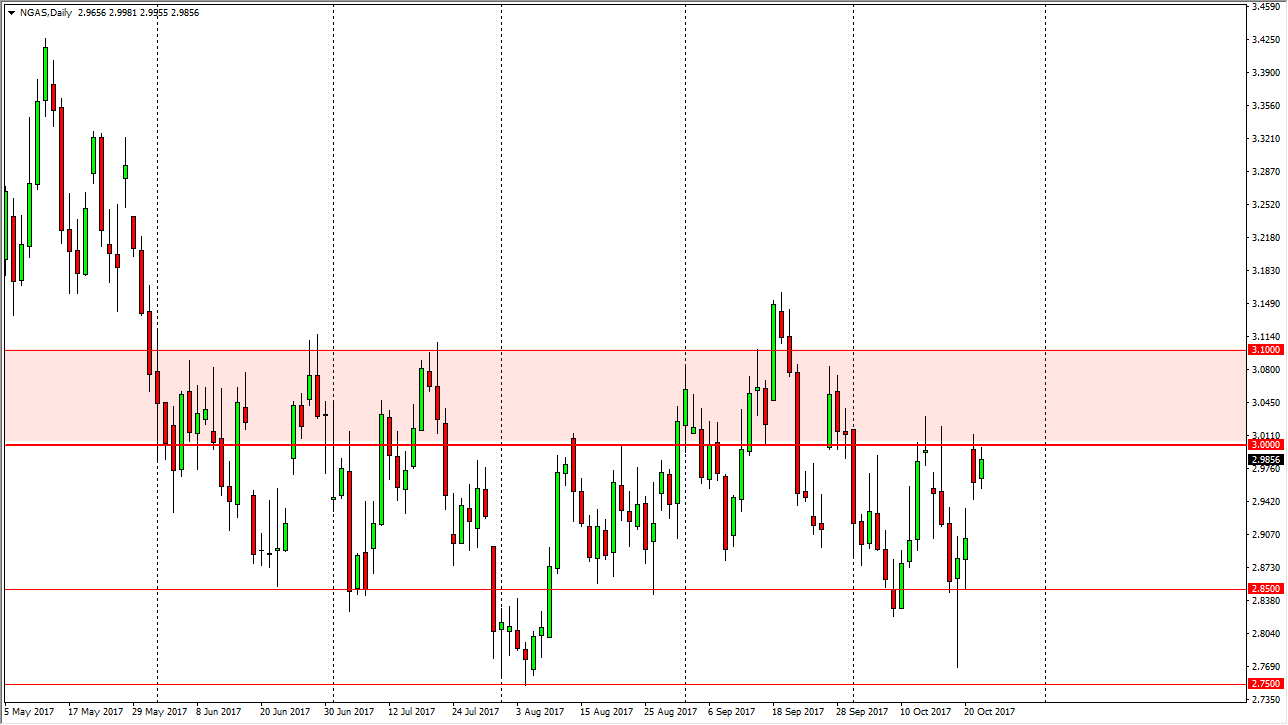

WTI Crude Oil

The WTI Crude Oil market initially fell during the trading session on Tuesday, reaching towards the 20 day exponential moving average. The market looks likely to try to break above the $53 level, and once we do, I believe it’s a buying opportunity. Once we clear $53, I think that the next target will be the $55 level above. I also believe that the $50 level underneath is massively supportive, so nonetheless, I am a buyer until we break down below that level. If we can clear the $53 level, we may run towards the $55 level rather quickly, and with serious momentum. Ultimately, this is a market that will continue to be very noisy as the US dollar has been moving quite a bit, and of course there are a lot of moving pieces in the crude oil markets.

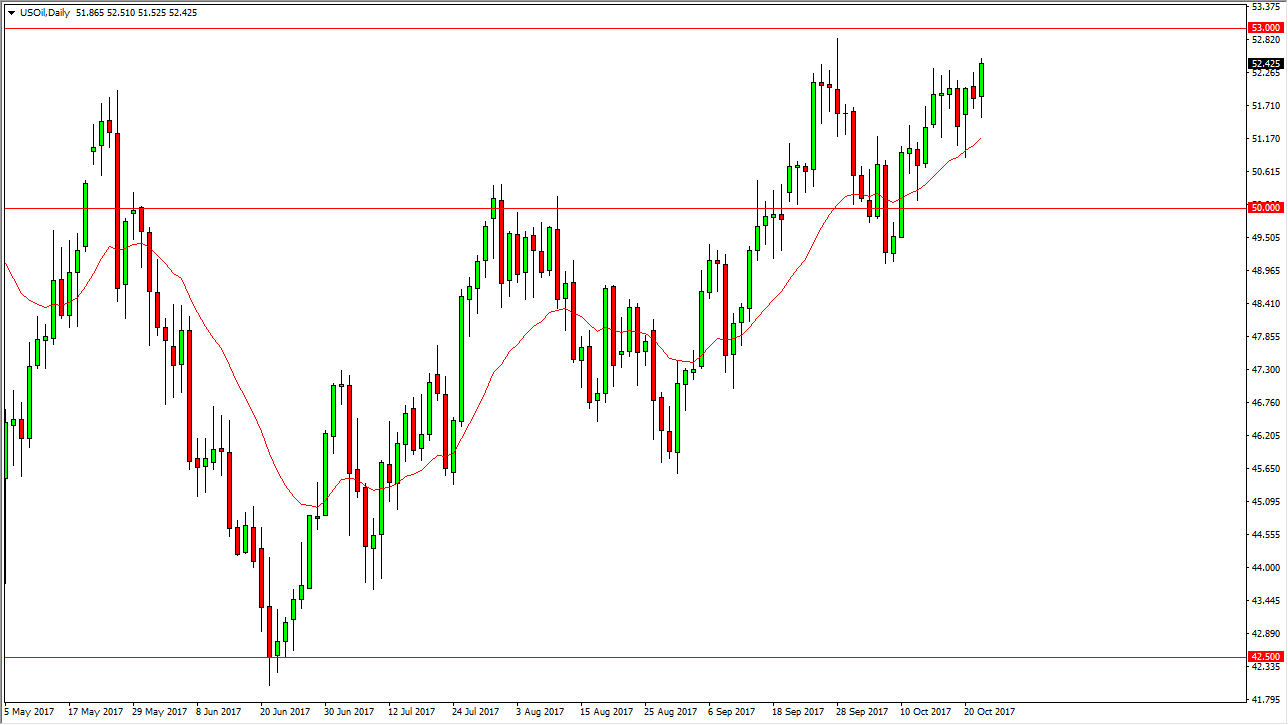

Natural Gas

Natural gas markets went back and forth during the day on Tuesday, testing the $3.00 level. That’s an area that should offer quite a bit of resistance, mainly because the US fracking companies continue to be aggressive in that area as far as dumping supply off, as they become profitable at that point. Because of this, I think it’s a long time before we can break above there with any significance, and that being the case, it’s likely that we will see more of the same back and forth type of attitude. The $2.85 level underneath is supportive, and I think that the same strategy should work going forward, simply selling rallies at the first signs of exhaustion. I believe that the gap over the last couple of sessions should be filled rather quickly, just as we have done so many times in the recent past.