from The Conversation

— this post authored by W David McCausland, University of Aberdeen

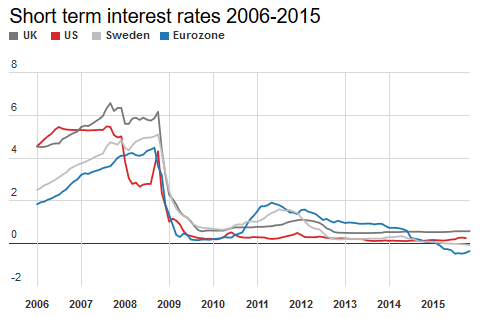

With the US Federal Reserve seemingly set on raising interest rates, it’s time to take stock of what low rates have done for the world. And what the prospects are when this era of low interest rates comes to an end.

Since the financial crisis, short-term interest rates have been close to zero in most major economies. The US Federal Reserve has held interests around 0.25% for the last seven years. Meanwhile, the UK’s bank rate remains at 0.5% and in Sweden the central bank has set a negative nominal rate.

The reasons are straightforward. Interest rates reflect the cost of borrowing so low rates make it cheaper to borrow to invest. This investment should increase growth, create jobs and ease the economy out of recession. Here’s what seven years of rock bottom interest rates have done in reality.

Investment

So low interest rates should have been great for investment. This has not exactly been the case, however. Investment as a share of GDP fell after the financial crash in the US, UK and eurozone, but has taken a long time to recover, and hasn’t yet regained pre-crash levels.

This is because the fall in real wages after the financial crash means labour has been relatively cheap, decreasing the incentive for firms to undertake capital investment. Plus there are ongoing concerns about weak demand both in the UK, the eurozone and the wider global economy, which also inhibit investment despite low interest rates. Fears of this weak demand may explain why rate rises in the relatively open economies of the UK and the eurozone have been delayed compared to the US, which has experienced buoyant domestic demand in recent months.

Consumption

One effect that may come back to bite us is the effect of low interest rates on consumption. Some commentators fear that the UK’s recent recovery, for example, is fuelled by consumption based on household debt. Any rise in interest rates may choke off that channel of recovery, and may mean some borrowers cannot repay their loans.