As a natural progression from the analysis of one historical bond “bubble” to the latest, it’s statements like the one below that ironically help it continue. One primary manifestation of low Treasury rates is the deepening mistrust constantly fomented in markets by the media equivalent of the one historical bond “bubble”.

That narrative “has ruffled a few feathers,” BMO Capital Markets strategists Ian Lyngen and Aaron Kohli wrote in a note last week. “Growth is moving at a solid clip and the labor market is ostensibly at full employment — so why aren’t we in an environment with a steeper curve and higher yields?”

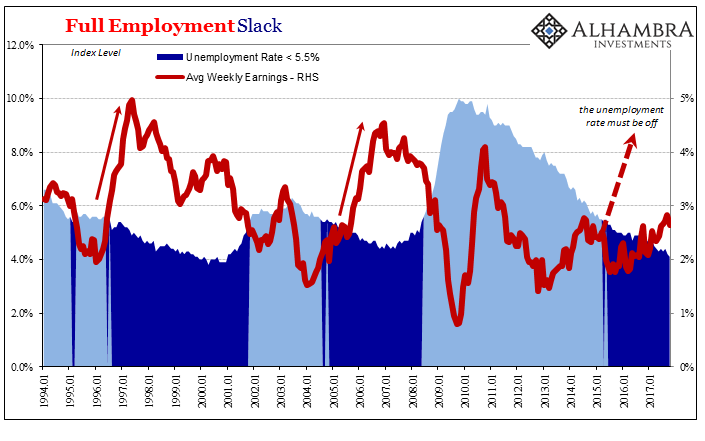

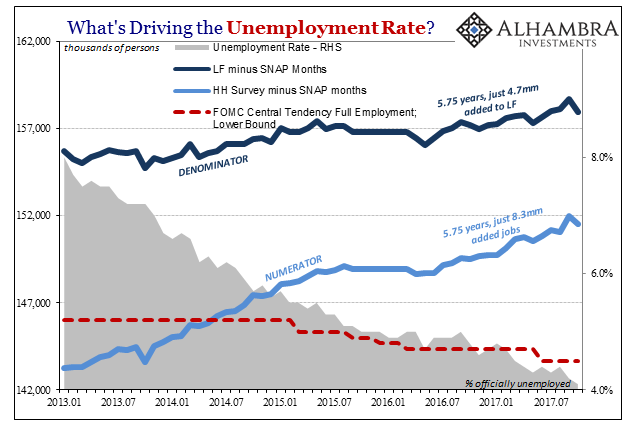

If solid growth plus full employment equals a steeper yield curve and higher long rates, and they do, then a flatter curve at lower nominal rates must then equal what? The answer is far easier than the media makes it out to be. In what is pure Aristotelian sophistry, they try very hard to ignore their own logic where the answer to this “conundrum” is clearly choppy, lackluster growth that has left the (global) economy considerable hangover slack.

That’s what the yield curve continues to say, the only thing it has said for many years now.

It’s amazing that after more than a decade now of these markets (UST’s, eurodollar futures, swaps, FX, etc.) declaring that “something” is wrong how easily it is for these people to simply set it all aside because their highly optimistic view on the economy, derived exclusively from central bank forecasts and actions, just has to be right. They are actually saying that markets need to conform to their opinions without evidence, and without recognizing the market prices are evidence, as if theirs is the only correct possibility. Time plays a significant component of that backwards view because it is extremely hard to believe the global economy could ever be stuck in such an awful place for so long.