This week’s economic news is mostly jobs-related. The Fed has cited employment as the most important factor in future rate decisions. There is plenty of FedSpeak on tap. Pundits love to talk about the Fed. Voila! The theme for the week will combine all of these elements:

Can the employment news change the Fed’s course?

Prior Theme Recap

In my last WTWA I predicted that attention focus on markets rather than the economic reports. In particular, I suggested several different viewpoints about expected market action. While each of these got a riff or two during the week, I was expecting the main theme to be the challenge to the top of the trading range. With the soft start to the week, the upside breakout potential got little attention.

Feel free to join in my exercise in thinking about the upcoming theme. We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead.

This Week’s Theme

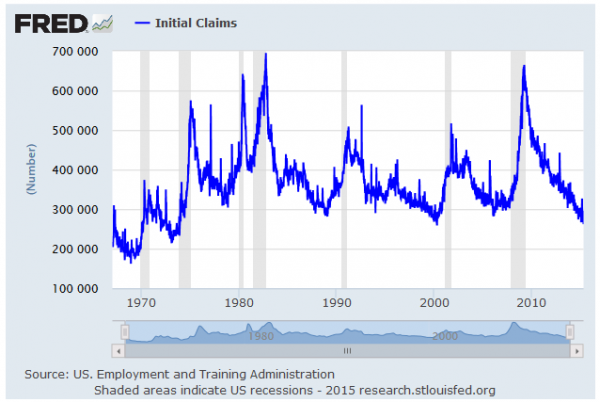

This week’s economic news is mostly about employment. At week’s end we will get the monthly employment situation report, with plenty of angles and spin potential. In addition we will see the ADP private employment report, news about layoffs, initial jobless claims, and a report on service sector employment. The Fed is giving special attention to employment, watching for signs that the labor market is getting tight and wage pressures mounting. This week I expect discussion to center on employment and the aftermath of last week’s FOMC rate meeting. Fed speakers will be out all week, discussing the data and answering questions. Analysts will be asking:

Can the employment data change the Fed’s course?

The Viewpoints

Fed policy is a favorite market topic, eliciting a range of viewpoints encompassing both economic prospects and prospective rate tightening. Here are the leading candidates:

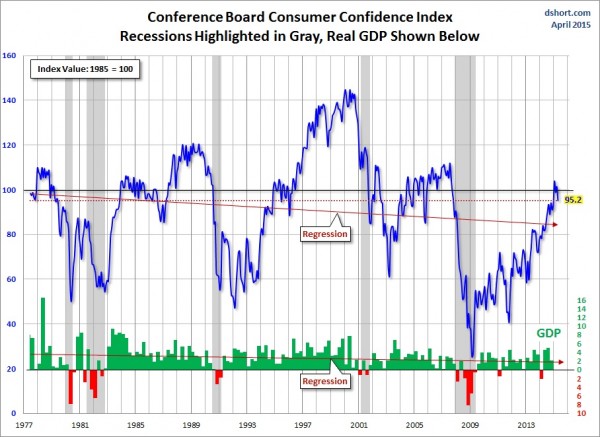

- The economy remains very weak, so the Fed is on hold. (Numerous super-bears).

- The economy remains sluggish, but the Fed will begin a modest rate increase program nonetheless. (Tim Duy).

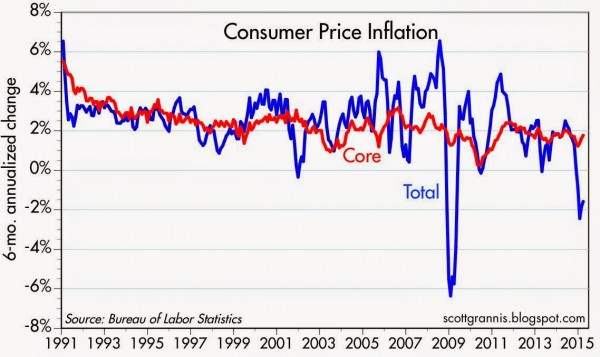

- There are already signs of inflation and the Fed will begin rate increases by September. (Scott Grannis)

As always, I have my own ideas in today’s conclusion. But first, let us do our regular update of the last week’s news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week’s Data

Each week I break down events into good and bad. Often there is “ugly” and on rare occasion something really good. My working definition of “good” has two components:

The Good

There was some good news in a mixed week.

The Bad

The news also included some negatives.

Q1 GDP was barely positive, showing a gain of only 0.2%. Conclusions about this weak report vary widely.

- The meager gains are to be expected in a new world of recessions. (ECRI).

- One-time factors explain much of the weakness (summarized with links by Mark Thoma).

- Seasonal factors take this down from a more accurate read of a 2% gain (Barron’s).

- Core GDP is a much better measure, focusing on the domestic economy and avoiding variation in exports and inventories. Bob Dieli’s reports are both witty and sophisticated. His analysis shows why the current weakness is not like the prior pre-recession bouts. He has agreed share this report with our audience. As a bonus, you will also learn Bob Uecker’s advice on how to catch a knuckleball!