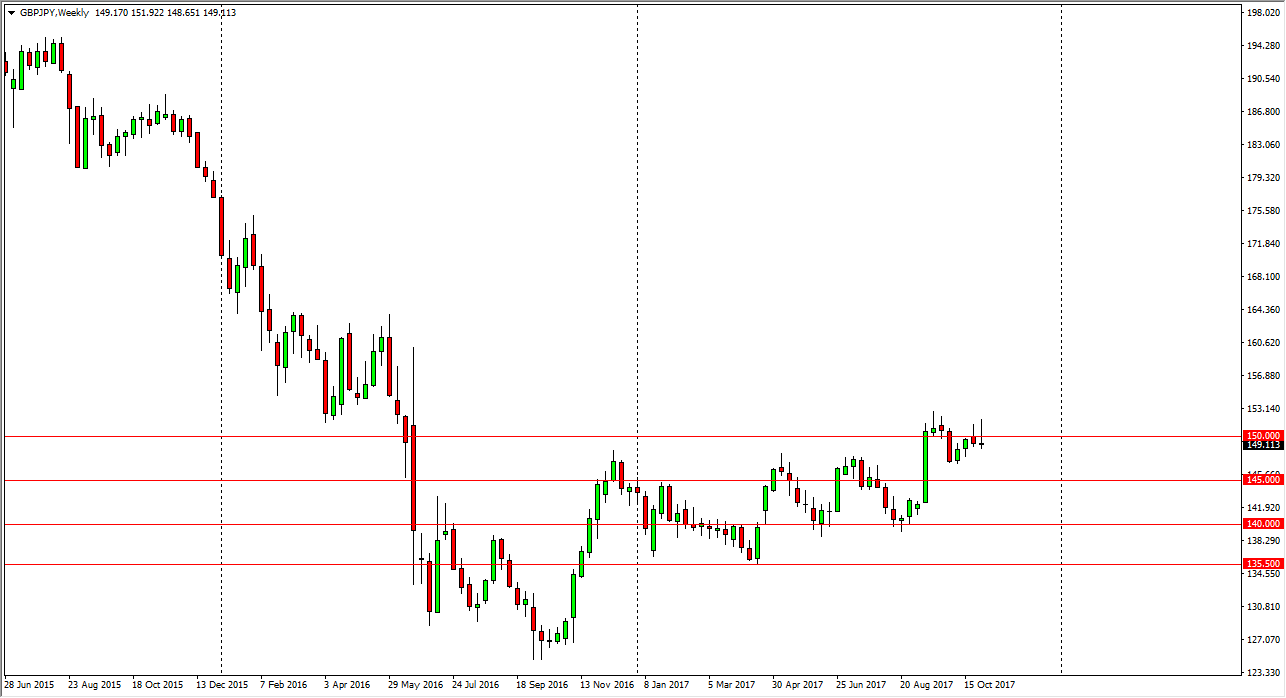

GBP/USD

The British pound tried to rally against the Japanese yen initially during the week, but sold off against almost everything after Mark Carney suggested that additional interest rate hikes are not coming any time soon. We did see a rate hike this week, but it may be a while before we get another one, putting bearish pressure on the British pound. I think that we are going to drop over the next week, perhaps down to the 146 handle.

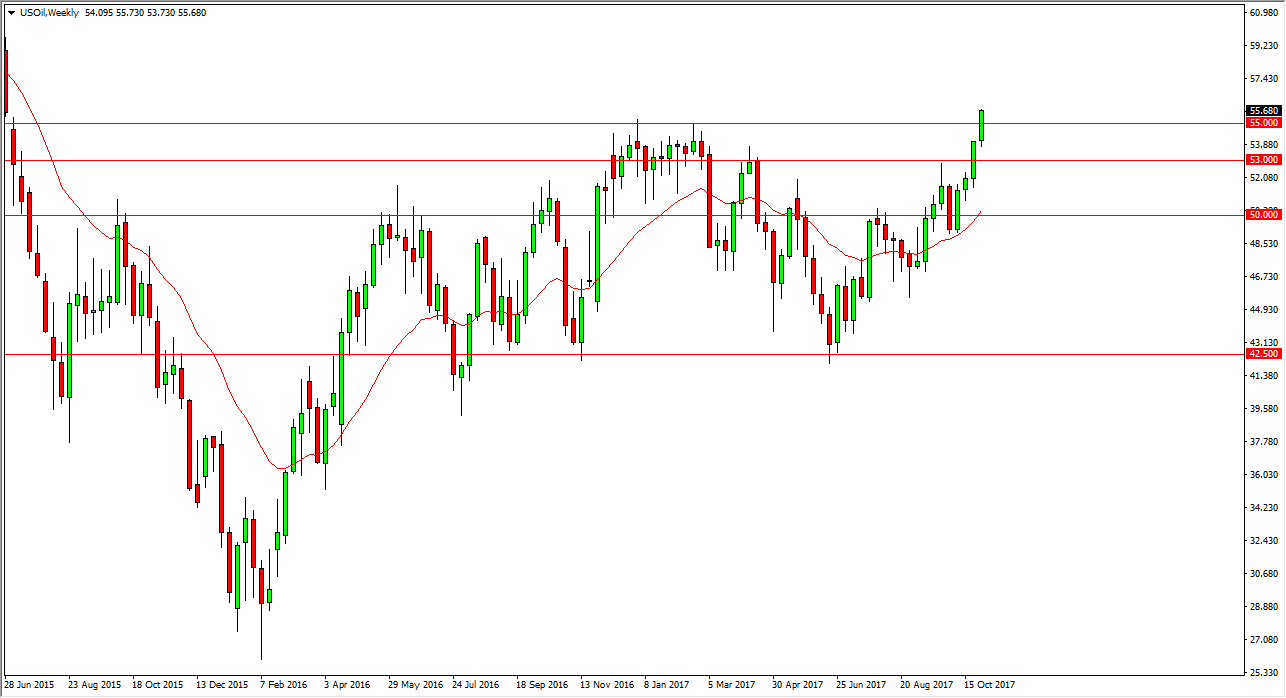

WTI Crude Oil

The WTI Crude Oil market initially tried to fall during the week, but then shot through the $55 handle closing towards the very top of the range at the end of the week. I think that it is only a matter of time before buyers get involved, perhaps trying to look for value on short-term charts when we pull back. I think the $60 level should be a target, but if we can break down below the $53 level, it’s likely that the crude price will drop significantly.

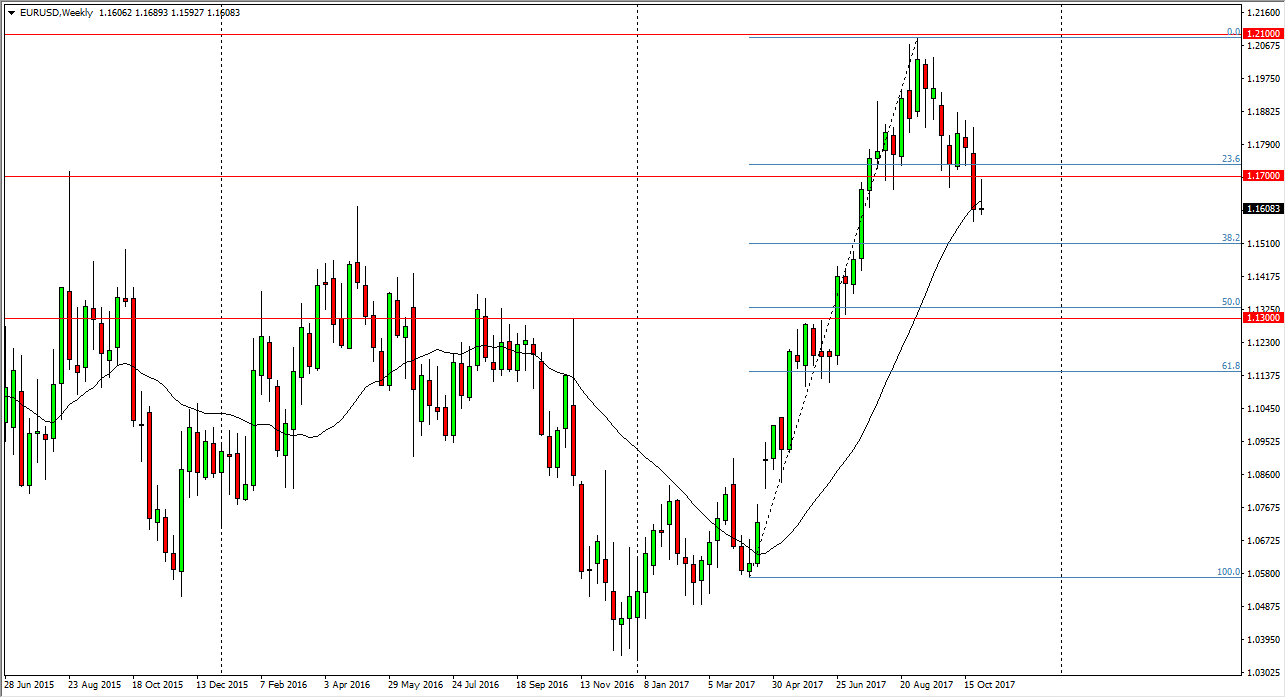

EUR/USD

The EUR/USD pair initially tried to rally during the week but found the 1.17 level to be far too exhaustive and resistant to continue to go higher. In fact, it is a neckline that we have broken below the bottom of the head and shoulders on the daily chart, and I think that should continue to drive this market lower, perhaps down to the 1.13 level. I have no interest in buying this market and in the short-term believe the pair will turn negative.

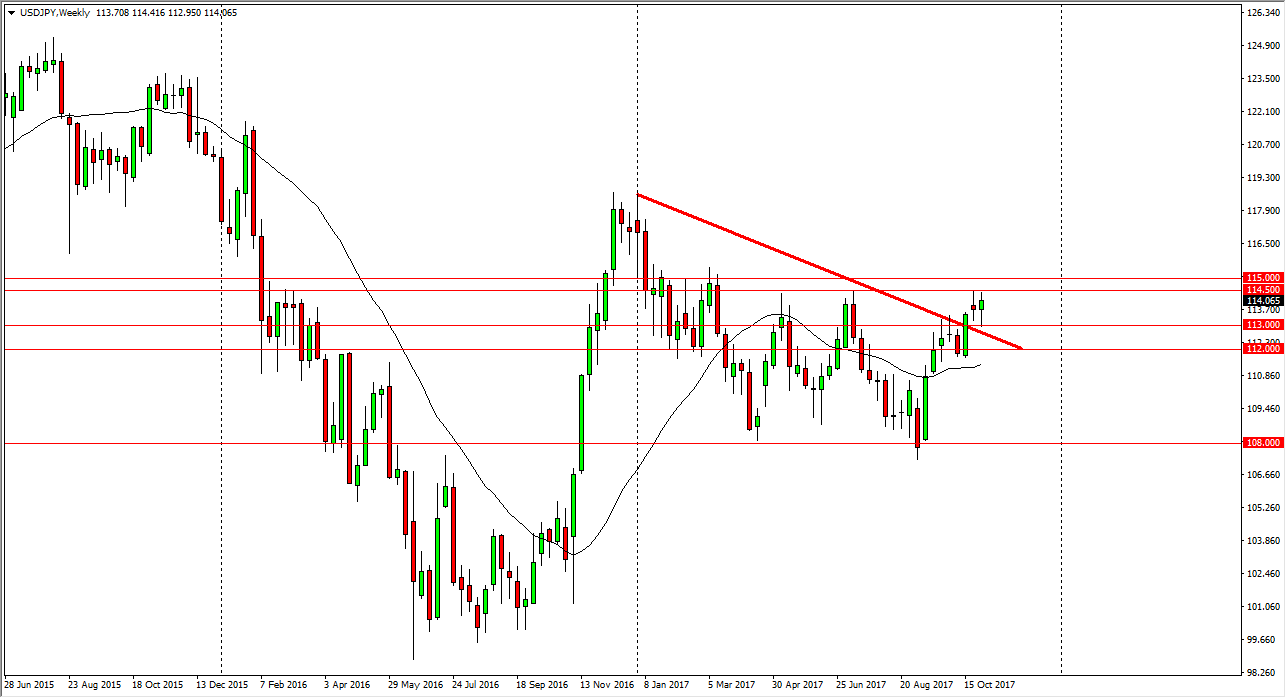

USD/JPY

The US dollar fell against the Japanese yen during the week, but bounced from the 113 level to turn around and reach towards the 114.50 level. I think we are going to continue to find buyers on dips, as USD/JPY tries to finally break out above the 115 handle. If we can clear that level, it becomes more of a “buy-and-hold” market.