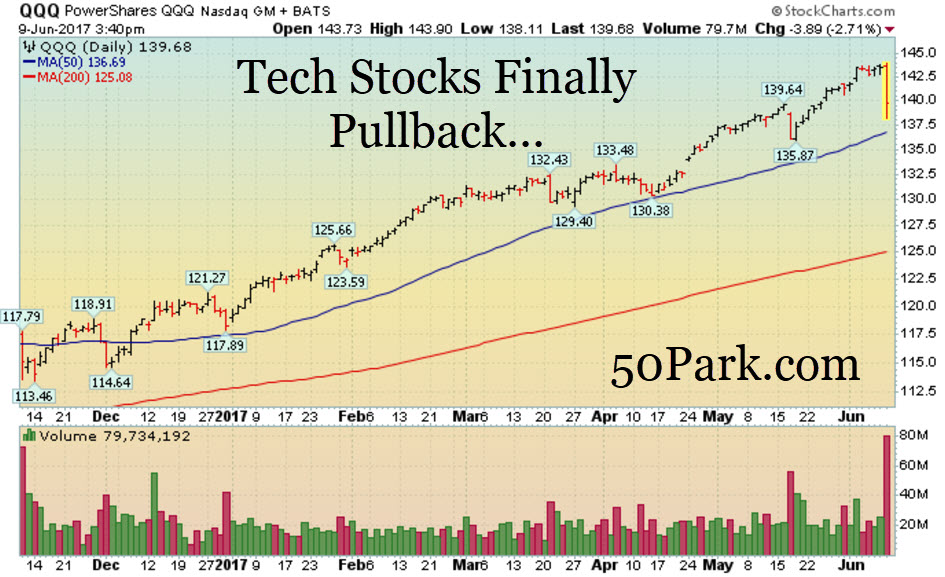

Something important happened on Friday, when big investors dumped tech stocks (leaders) and bought the laggards! (small-caps and other under-performing sectors such as biotechs, retail, and financials, just to name a few). For now, this points toward rotation and with rotation comes new/emerging opportunities. As they say, follow the money!

In the short term, last month’s lows are the next level of support to watch, then the 50 DMA line for the S&P 500, Dow Industrials, Nasdaq Composite, and Nasdaq 100. After that, the next important levels of support to watch are: Russel 2000: 1351, then 1335, then 1308. The Dow Industrials: 20.6K, then 20.4k, S&P 500: 2352, then 2322.25, Nasdaq Composite: 5995, then 5805, then 5769.39. Until those levels are breached on a closing basis, the bulls remain in control on a short, intermediate, and long-term time-frame. The Russel 2000 tried to break out of range after moving sideways all year which bodes well for this ongoing and aging bull market. Keep in mind, if the selling gets worse, a defensive stance is warranted.

A Closer Look at What Happened Last Week…

Mon-Wed Action:

Stocks were quiet on Monday as investors waited for a big week of data. The PMI service index came in at 53.6, missing estimates for 54.0. Factory orders fell to negative -0.2%, which matched estimates. The ISM non-manufacturing index came in at 56.9, missing the Street’s estimate for 57.0. Stocks slid on Tuesday as investors waited for the ECB and Mr. Comey’s testimony on Thursday. In the afternoon, after ABC News reported, citing a source, that former FBI director James Comey will not say that President Donald Trump obstructed justice. But that did little to excite investors. MBA mortgage applications came in at +7.1%, beating last week’s -3.4% reading.

Stocks were quiet on Monday as investors waited for a big week of data. The PMI service index came in at 53.6, missing estimates for 54.0. Factory orders fell to negative -0.2%, which matched estimates. The ISM non-manufacturing index came in at 56.9, missing the Street’s estimate for 57.0. Stocks slid on Tuesday as investors waited for the ECB and Mr. Comey’s testimony on Thursday. In the afternoon, after ABC News reported, citing a source, that former FBI director James Comey will not say that President Donald Trump obstructed justice. But that did little to excite investors. MBA mortgage applications came in at +7.1%, beating last week’s -3.4% reading.

Thur & Fri Action:

Stocks were quiet on Thursday even after the ECB meeting and Mr. Comey spent most of the day testifying on Capitol Hill. Friday was a big day on Wall Street as investors finally dumped some of the high-flying tech stocks and bought some of the lagging sectors. At one point, the Nasdaq was down 2% after several big cap tech stocks fell in heavy volume. Overnight, Theresa May lost a big election which changed the balance of power post-brexit.