The age of the Great Wealth Transfer is already upon us. Over the coming 25 years, as much as $68 trillion in wealth will be passed down from the Baby Boomer generation to their assorted inheritors.

The sheer volume of money, assets and equities changing hands in this timeframe is unprecedented and will hold countless challenges and opportunities within the fast-paced world of wealth management.

The reason such a massive shift in wealth is beginning to occur is down to the fact that the world’s burgeoning Baby Boomer population – that is individuals born in the decades immediately following the Second World War – is beginning to reach retirement age. With the oldest ‘Boomers already reaching the age of 73, while younger members of this transformative generation are aged around 55, members of the Millennial generation are already beginning to receive vast sums of inheritance that they’ve never before been familiar with.

So, with this in mind, let’s take a moment to investigate further the brave new world of wealth management, and explore the options open to individuals who find themselves inheriting significant sums of money.

Different forms of inheritance

(The transfer of wealth can be a complex process for all involved parties. Image: Behance)

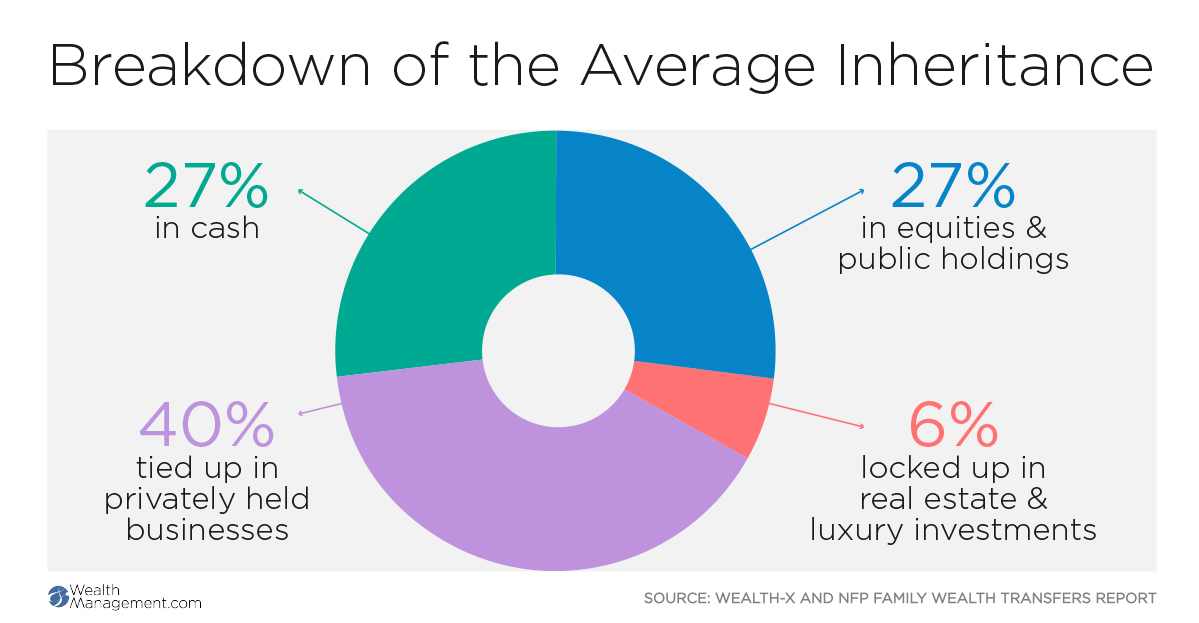

The topic of inheritance can be an especially tricky one because wealth can arrive in a range of different forms. The most likely type of inheritance that friends and families could receive would ultimately be tied up within privately held businesses – whether that’s through a family-owed company or shares in a non-governmental organisation.

With 40% of inheritance locking into businesses in this way and only 27% of the average wealth transfer representing full liquidity, this makes the management of wealth for inheritors more complex than they may have initially anticipated.

Receiving inheritance in this sort of way can lead to difficulties in navigating your way towards using this newfound wealth to achieve your goals. If you receive the family business, there could be pressure to oversee its operations rather than looking to sell on to a willing buyer – the same could apply to the 6% of benefactors who receive wealth locked up in the form of real estate and luxury investments.

Here, it’s highly advisable to call on the help of a wealth management firm to actualise your ambitions and run you through the logistics of re-investing received assets.

Financial literacy

Recommended For You Webcast, March 5th: How AI Can Find Opportunities and Shorten Your Sales Cycles

Register Now

(Shifting wealth means more financial education is needed for the next generation of investors. Image: Wealth Management)

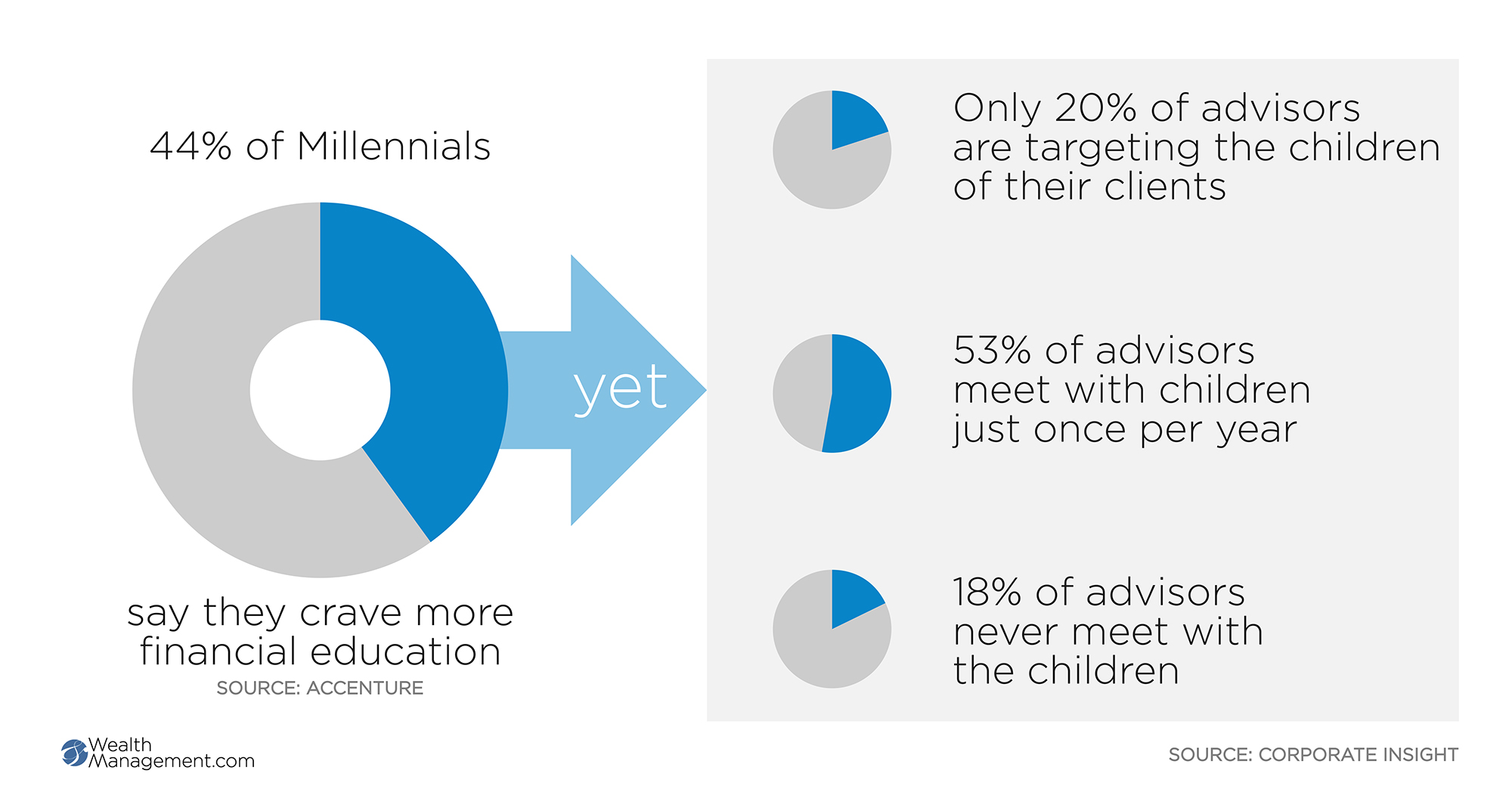

One of the greatest challenges that inheritors will face, whether they’ll find themselves as members of the Millennial generation, Generation-X, or Generation-Y, will centre around the sudden need of greater financial literacy.

As many as 44% of Millennials claim that they require more financial education, with very few industry professionals currently making preparations in order to cater towards their needs. In fact, only 20% of wealth management advisors have begun targeting the children of their clients in a bid to raise awareness of their prospective incoming inheritance. While around half of the industry professionals of today make the effort of meeting the children of clients just Wealth Management.

The Great Wealth Transfer will bear huge ramifications for the industry of wealth management as well as those who stand to inherit such large volumes of money and assets.

The topic of wealth transfer within families can be a prickly one, but if you suspect that you may be influenced by the Great Wealth Transfer, it’s imperative that you get to work on building some level of financial literacy before you begin to look at your option.

It’s estimated that up to 70% of individuals go on to squander their inheritance when it’s passed down a generation – with the figure rising to 90% by the time it is moved on to a third generation. These figures may be worrying but they can be effectively mitigated by individuals taking pre-emptive steps in looking at how to react to inheriting large sums. Fundamentally it’s also important to refrain from making any rash decisions when it comes to finance.

Attaining a greater level of financial literacy can also help inheritors to better understand the various levels of taxation that impact the passing down of finance and assets in their respective countries.

Investment vehicles

Of course, depending on the respective size of your inheritance and your individual wants and needs, it could be advisable to place your assets into a specific investment vehicle. This method has the potential to yield far greater returns than through, say, depositing money into your bank account.

This approach will enable you to utilise your ISA allowance for further tax efficiency. It can also make fiscal sense to invest in stocks and shares by setting up a new Lifetime ISA. This is a relatively safe form of investment and can come with some healthy bonuses depending on the level of money that you invest. Alternatively, the Innovative Finance ISA can work well for adopters and it’s even possible to invest your inheritance into a mixture of ISAs that suit your financial goals.

Many financial organisations offer the option of investing into ready-prepared portfolios that are made up of a series of shares, bonds and various other assets in order to minimise the risk posed to investors through the comfort of diversity.

It’s also worth taking a moment to think about your pension and the possibility of bulking it up with some inheritance money. With as much as 25% of your pension fund available as a tax-free lump sum coming after you turn 55, this can make for an effective way of insuring your inheritance against the burden of taxation – and even opens up your finances to the possibility of being passed on to further beneficiaries via a dedicated pension fund.

Future planning

Fundamentally, it’s important to ensure that you’ve constructed a plan for the future. The Great Wealth Transfer is going to prompt a seismic change in the way wealth management services operate, and millions of Millennials worldwide are set to attain volumes of money and assets that had previously been unimaginable to their generation.

The next 25 years will see plenty of change as to who holds the majority of wealth worldwide. It’s vital that those who stand to benefit from the Great Wealth Transfer are fully clued up on its implications, as well as aware of their own life goals that the wealth can help to achieve.