Wheeee – this is fun!

As you can see from JackDamn’s index chart, the Russell Small Caps have now given up ALL of their gains for the year and, even a little bit lower and we won’t be looking at a small correction anymore. Generally, we like to “short the laggard” – or the index that has fallen the least but the Nasdaq is a strange animal and all of it’s outperforming gains are due to Apple (AAPL) – and we think AAPL deserves to be at $160, so we don’t see it as particularly overpriced compared to the Dow or S&P, though there are certain components in the Nasdaq (AMZN, NFLX, TSLA) that have ridiculous values and those may correct and drag the index down with them.

As you are well aware, we’ve been discussing options hedges and futures shorts all month so I hope you enjoyed yesterday’s dip as much as we did. Our two key shorts in our portfolios are the Ultra-Short Russell ETF (TZA) and the Ultra-Short Nasdaq ETF (SQQQ) and the Nasdaq is 4.5% off the top and the Russell is 7% off. By the way, we have the SQQQ hedges, not because we thought the Nasdaq would drop more but because our biggest long position is AAPL – so it gave us the best protection to lock in our gains.

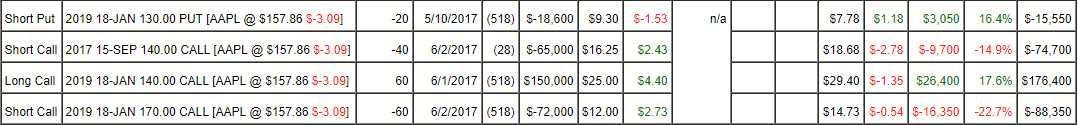

In fact, we just did a review of our Options Opportunity Portfolio, which is up an impressive 211% as of our two-year anniversary (8/8/15 was our start date with $100,000) and it is, by far, the best-performing portfolio in the Seeking Alpha Marketplace. That portfolio has the following AAPL position that, if successful will, by itself, make us $180,000 by Jan 2019.

Our net entry on the trade was a $5,600 credit, mostly in June and, though the short puts obligate us to buy 2,000 shares of AAPL for $130 ($260,000), which would use $130,000 of ordinary margin, AAPL is already far enough out of the money where the net margin requirement in the short puts is just $20,000 – so it’s a non-issue in our now $311,000 portfolio.

The Bull Call Spread pays 60 contracts x 100 options per contract x $30 at $170 and that’s $180,000 so, if this trade works out well, we will have a net profit of $185,600 (as we had the net credit) just 18 months after we started. The trade is now a net credit of $2,200 so we’re up $4,400 (78.5%) in just over 2 months but that’s only “on track” to our goal and it’s still a great trade if you could use an extra $182,200.