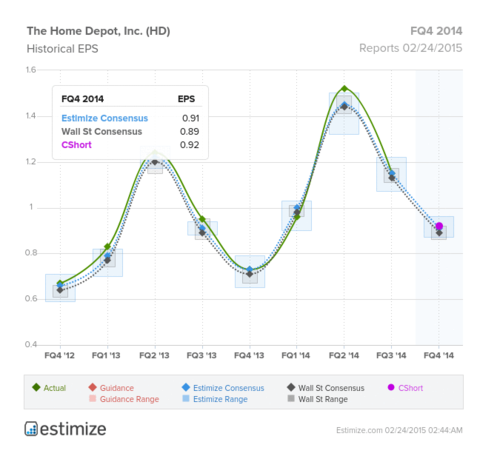

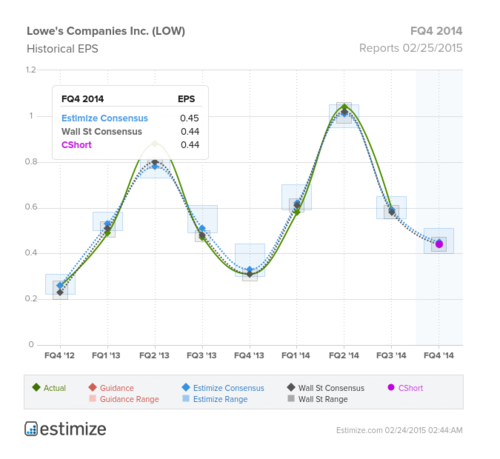

This week we get fourth quarter earnings results from the country’s two largest home improvement retailers. Home Depot is set to release earnings before tomorrow’s opening bell, and Lowe’s is out Wednesday morning. Estimize is expecting both companies to slightly beat the Wall Street consensus. Specialty retailers have done well this season, the blended growth rate for earnings currently stands at 10.3%, with revenues up 5.0%.

Home Depot is expected to post fourth quarter EPS of $1.91, two pennies higher than the Street’s consensus. This would mark the eighth quarter of double digit earnings growth in the last nine quarters. Revenues are expected to come in at $18.73B, about $60M higher than the Wall Street prediction, and only 4.2% higher than the year-ago period. The country’s largest home improvement retailer is expected to benefit from an increase in consumer spending in the latest quarter backed by falling gasoline prices and a better employment picture which has left people with more discretionary income. Improving macroeconomic conditions in the U.S. have spurred activity in the housing market, which was particularly strong towards the end of 2014. Some issues that have plagued other S&P 500 companies this season, such as the stronger dollar, will not be a problem for Home Depot as 87% of their stores are located in the US. The company’s stock recently leapt to an all time high of $112.45 on Feb 19.

Lowe’s is the country’s second largest home improvement retailer and is set to report Wednesday before the bell. The Estimize consensus currently stands at $0.45, a penny higher than Wall Street. This would represent growth of 45%, the eighth consecutive quarter of double digit earnings growth. Revenues are expected to come in at $12.3B, about $20M higher than the Street, marking YoY growth of about 6%, which is still great for a company of this size. Lowe’s should benefit from the same macroeconomic improvements that Home Depot will. Existing home sales is one of the most important drivers for the industry because existing homeowners typically make home improvements before putting a house up for sale. In October existing home sales hit a one year high, and while that figure dipped in November, it rose again in December, making Q4 a strong one for the existing housing market.