by Whitney Tilson

Summary

The selloff in Spirit Airlines’ (SAVE) stock, down 51% this year, is hugely overdone.

The company has amazing economic characteristics and the long growth runway, yet the stock trades at less than 9x earnings.

Over the next decade, I believe that Spirit – both the company and the stock – will do what Ryanair (RYAAY) has done over the past decade in Europe.

On Monday afternoon I presented Spirit Airlines as my favorite long idea at the Robin Hood Investors Conference. Since then, I’ve updated my slides and posted them here.

My investment thesis can be summarized in one sentence: there are very few companies I’m aware of that are growing 20%+, with 25%+ operating margins, 25%+ returns on equity, with net cash positions, whose stocks are trading at a P/E of less than 9x.

After soaring from $10 to $85 from 2011 through 2014, the stock has been crushed this year for a variety of reasons that I’ll discuss below, tumbling 51%, far worse than any other airline, as these two charts show:

I think this selloff is massively overdone. Despite its significant customer service problems and current price war with American Airlines, Spirit is – and will remain – an excellent business and has tremendous room to grow over the next decade.

Background

Spirit has 76 aircraft operating more than 350 daily flights to 56 destinations in the U.S., Latin America and the Caribbean. It is an ultra-low-cost carrier (ULCC), which is not to be confused with low-cost carriers like Southwest, JetBlue and Virgin America. ULCCs include Allegiant and Frontier in the U.S. and Ryanair in Europe.

Growth

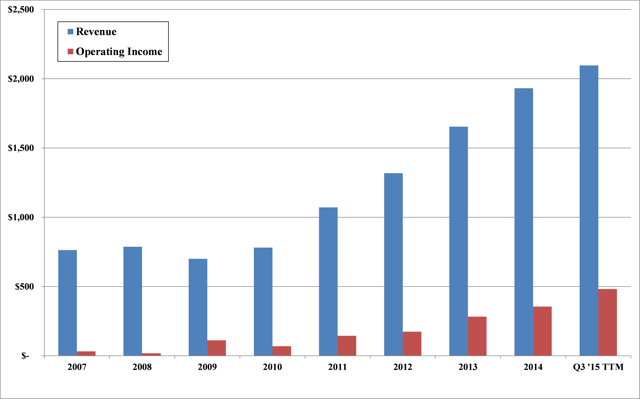

Spirit has been growing like a weed, tripling its revenue and more than quadrupling its operating income since the 2009 low, as this chart shows:

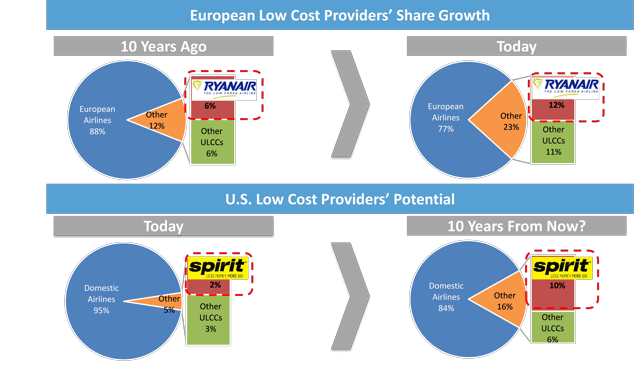

More importantly, Spirit has an enormous growth runway in front of it. It serves fewer than 200 markets currently, but believes that more than 500 markets meet its threshold for growth. I don’t doubt this and think that Spirit will continue to grow at a rapid clip for at least another decade, just as Ryanair has done in Europe over the past decade, as shown in this chart (courtesy of Kellogg MBAs Justin Hess, Alexander Hunstad and David van der Keyl):

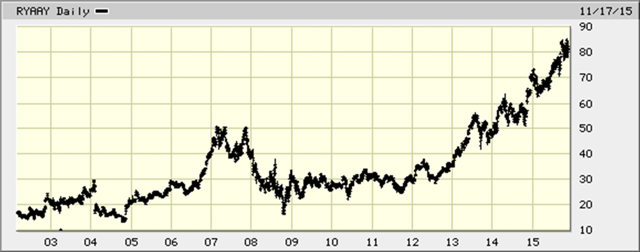

If I’m right, then I expect Spirit’s stock will perform along the same lines as Ryanair’s. Here’s a chart showing how well Ryanair’s stock (ADR) has done over the past 14 years:

Spirit’s Cost Advantage

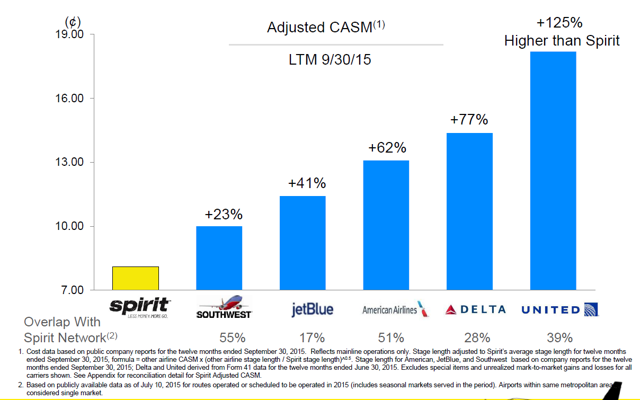

The key to Spirit’s success is its ultra-low costs, which translate into almost absurdly low prices (one personal example: yesterday I booked a round-trip nonstop flight on Dec. 8-9 from NYC (LaGuardia) to Dallas (DFW), for $43.09 each way). Here’s a chart from Spirit’s investor presentation showing its cost advantage vs. its major competitors:

(Note in particular the 62% cost advantage vs. American, which has started a price war against Spirit – discussed below. Hmmm, I wonder who’s going to win that one???)

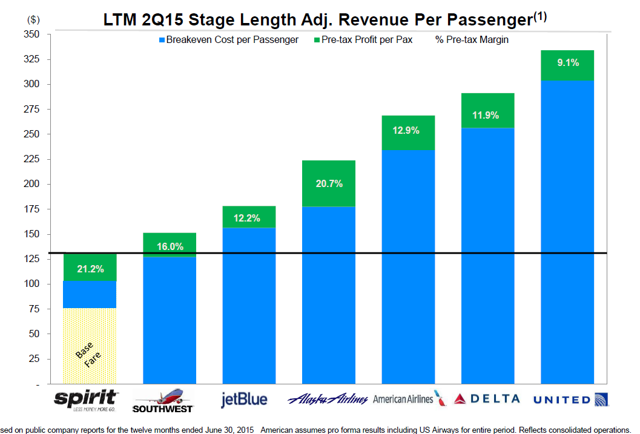

In fact, Spirit’s costs are so low that its total average price (including extras and the company’s very high profit margin) is lower than its competitors’ costs, as this chart shows:

Spirit’s extremely low costs are driven by many factors: