After 2 poor, tailing auctions earlier this week, moments ago it was a bit of a relief for Treasury bulls to see that today’s $28 billion issue of 7Y paper finally stopped through the 2.338% when Issued, printing at 2.335%. The strong headline result took place even though, as reported earlier in the week, there has been no scarcity of collateral in repo, and thus no pervasive overhang of shorts who get squeezed into the auction.

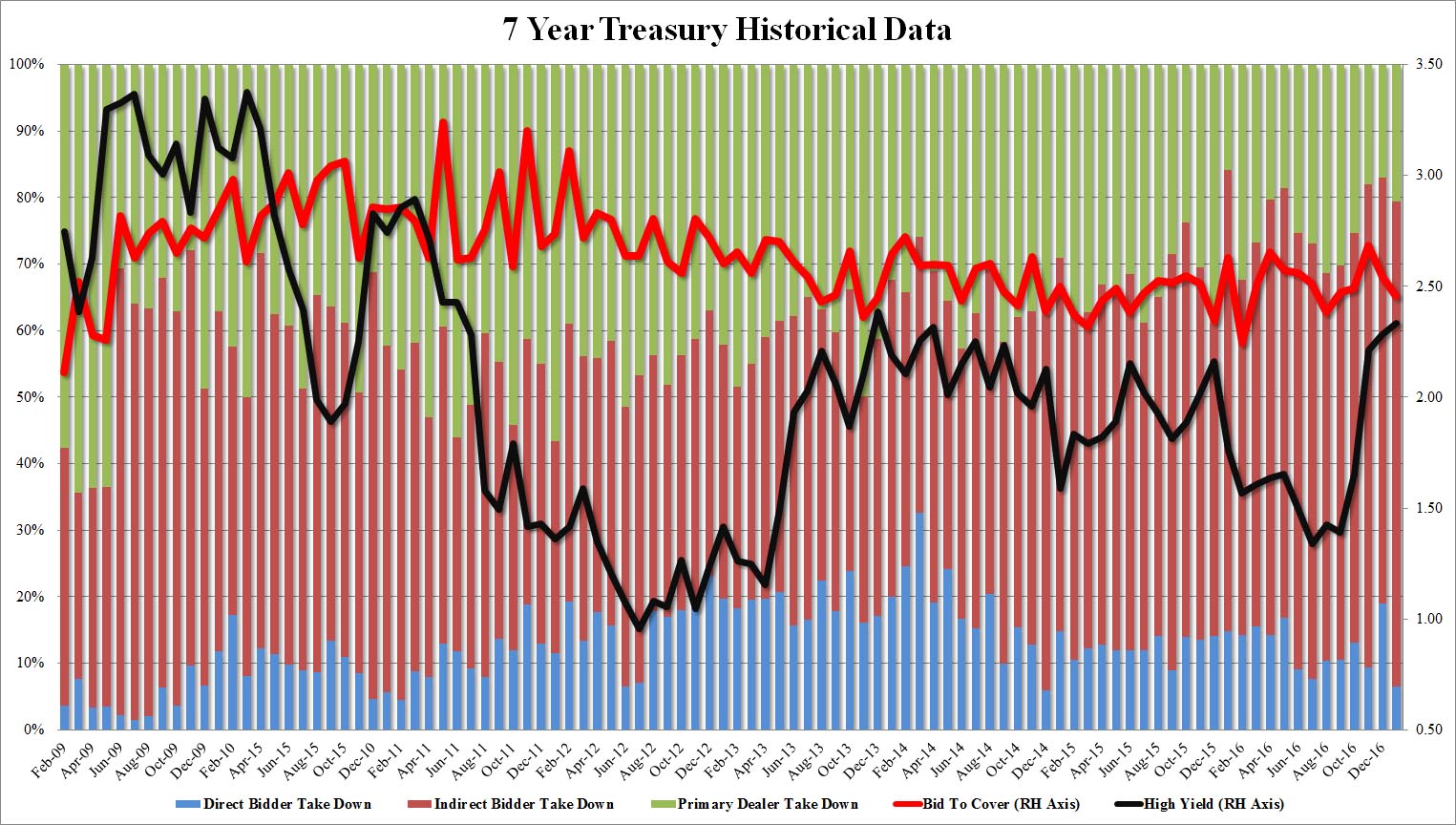

The internals in today’s auction were also better than in the 2 and 5 Years, because while the Bid to Cover declined modestly to 2.454 from 2.545 in December, and in line with the 2.42 6MMA, it was the surge in Indirect bidders, which took down a record 72.8% of today’s auction that shows that foreign bidders are finally back in the game, especially for longer-maturity paper. And with Directs taking down 6.6%, it meant Dealers were stuck with 20.65%, or the lowest since December 2014.