The ruinous tussle for market share between tight oil producers in North America and, in the main, members of Organization of the Petroleum Exporting Countries, OPEC, saw crude oil prices slump by more than 70% from the second quarter of 2014 to twelve-year lows in the first quarter of 2016. Prices have rebounded somewhat, driven by a production reduction accord reached on Nov. 30, 2016. The accord which was reached by twenty-four OPEC and non-OPEC producers aimed to rebalance the oil market by reining in the massive supply overhang.

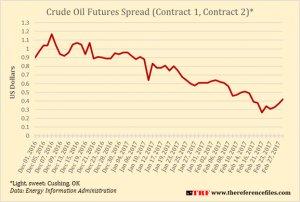

There are indications that the accord may be having its intended effect on the oil market. With the narrowing of the spread between front month and second month for the U.S. benchmark for example, traders that had bet on contango – having stored oil lots bought cheaply with a bid to sell later at much higher prices – are finding it increasingly less profitable to keep the lots in storage. And so, from storage such as in the Gulf of Mexico and South Africa, crude oil is slowly being shipped out.

While there is a perception that global oil market rebalancing is on track, there are issues that may derail the process; and these four are informative.

Accord Compliance

The aggregate compliance rate for the first month of that production reduction accord was high, though some of the production cuts agreed under the accord represent natural production declines which would have happened with or without the accord. Non-OPEC compliance was about 50% while that of OPEC stood at about 97%. However, it is anyone’s guess if that compliance rate – or even any significant rate – can be sustained, especially where there are neither credible production records nor effective sanctions for production violations. In the case of OPEC, for example, production cuts were allotted to members based on October production figures derived from secondary sources. However, according to an analysis by Petroleum Economist

(subscription required), Iraq, which claims that her October output was at least 250,000 barrels per day (bpd) higher than the basis for her allotted value, only cut production by 109,000 bpd, about 52% of the pledged 210,000 bpd in the first month of the accord. In addition, records show that the country’s exports increased in February. Angola is also reported to have fallen short of her pledged reduction target for the month of February.