Summary:

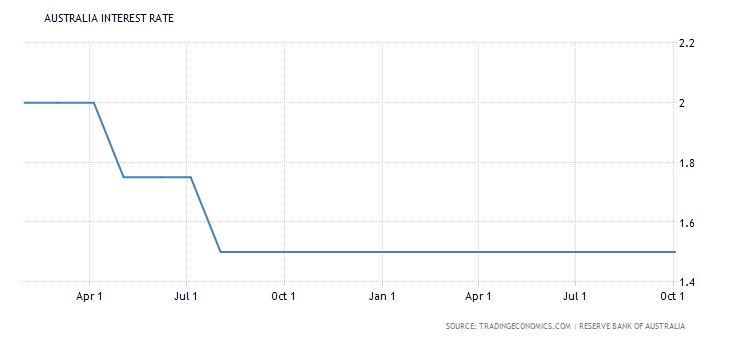

The Reserve Bank of Australia held its monetary policy meeting last week. As widely expected, the central bank left interest rates unchanged at 1.50%. This marked fourteen consecutive months of interest rates staying put at 1.50%.

Interest rates expected to remain steady in the near term

The central bank signaled that this steady interest rate would continue for some time in the near future on the basis of its neutral bias in the monetary policy statement which said that “the low level of interest rates is continuing to support the Australian economy.”

Australia Interest Rates: 1.50%, September 2017. Source: Tradingeconomics.com

The central bank said that based on the available information, it felt appropriate to hold the rates steady which is expected to be consistent with the current growth forecasts. Rates are likely to be held steady in the near term, at least until the next quarterly inflation and GDP data is released.

This will probably see the markets speculating that a possible RBA rate hike could come over the next quarter, meaning that rates are likely to remain unchanged towards the end of the year.

RBA upbeat on labor market developments

The main take away from the RBA’s meeting was that it was growing more confident in the labor market. The central bank, in its statement, said that employment continued to grow strongly over the recent months, sounding optimistic. The central bank also said that increased employment in all states was consistent with the rise in the labor force participation rate as well.

Although this was some cheer for the market participants who expect the RBA to begin hiking rates, the overall theme was broadly neutral. Just a month ago, the central bank struck an optimistic note stating that it expected the unemployment rate to decline but only gradually over the next few years.