Fed’s QET To End Between 2020 & 2022

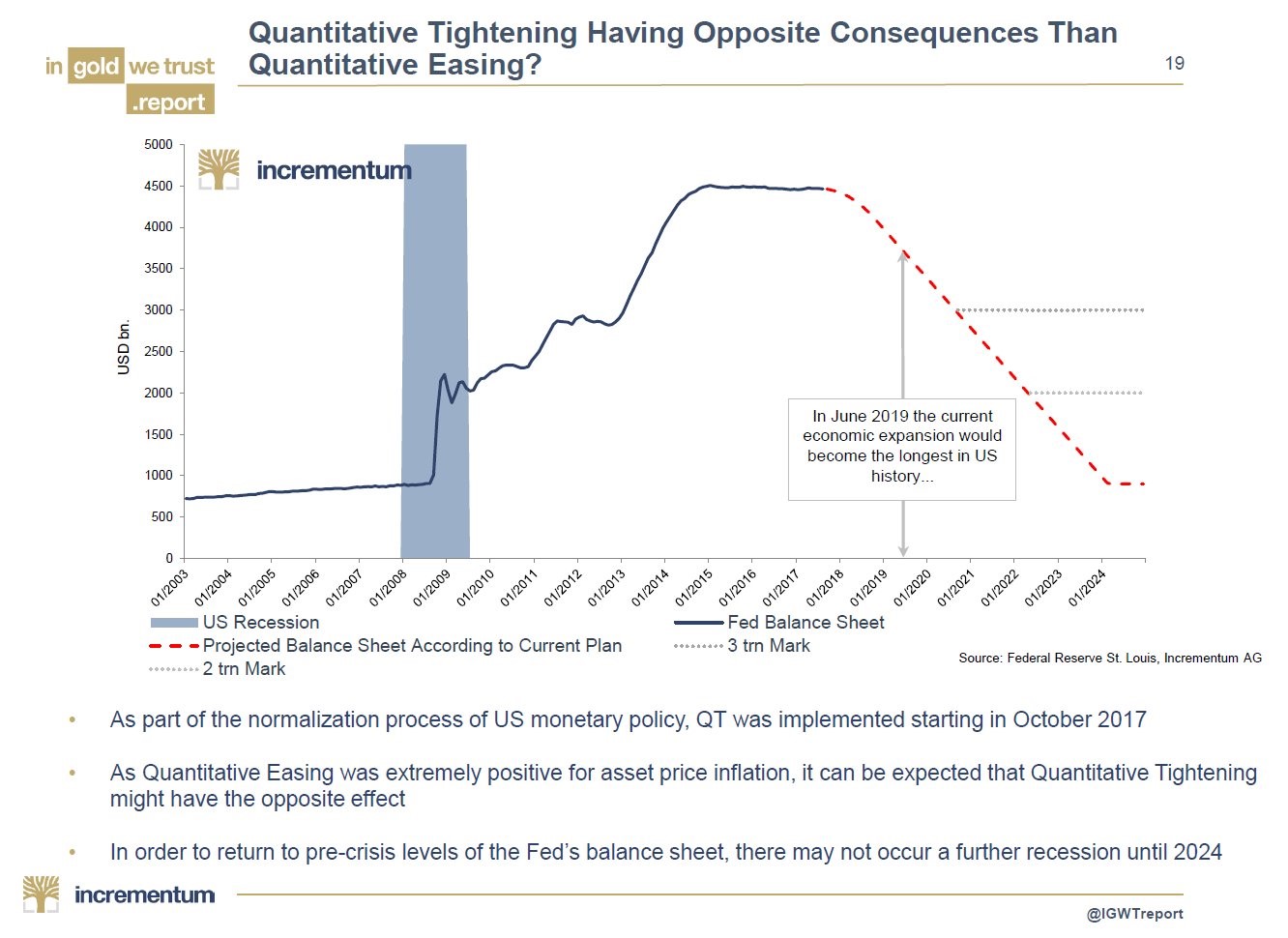

The chart below brings light to the timetable I’ve been discussing with regards to the Fed’s balance sheet unwind. I stated that it would be unlikely for the ECB to start an unwind before the next recession because its QE program will end in late 2018 or early 2019. That would mean a tightening would start in 2020 or later. I added to that point by saying I didn’t even think the Fed would finish its unwind before the next recession even though it is starting over a year before the ECB finishes its QE. As you can see from the chart below, the Fed’s balance sheet will be at about $3.5 trillion in June 2019 which will mark the longest expansion in U.S. history. I have no reason to think a recession will come in 2018, but it’s important to recognize that when you say you’re expecting the unwind to go smoothly, you’re saying that this will be the longest expansion by a year or two. The chart below is a bit misleading in the sense that it shows the balance sheet getting back to $500 billion. That is unlikely to happen. The unwind will end between the two grey dotted lines which represent the $2 trillion and $3 trillion marks.

Finally, I also disagree with the second bullet point which says asset prices went up because of QE, so they will go down once the balance sheet shrinks. The balance sheet was higher in the early 1940s and no stock crash occurred after it fell in relation to GDP. This time the Fed will unwind the balance sheet, unlike last time when the balance sheet simply grew slower than the GDP. My point is simply that if you’re expecting a crash because you think QE was the only reason stocks are up, you will be disappointed. It is one of a few factors that effect the markets.

Tax Reform A Popular Topic On Earnings Calls

FactSet compiles stats on the earnings calls in addition to giving aggregate data on S&P 500 earnings. As you can see from the chart below, one of the charts they did was showing how many conference calls mentioned tax reform by this point in the quarter. As you can see, the chatter has increased from the past two quarters, rivaling Q4 2016. Even though this chart reflects the positivity exuding from corporations, the political chatter has shifted from talking about the benefits to talking about the potential pitfalls. The tax reform plan no longer looks like a win for everyone. A consumer company that does a lot of business in states with high income tax rates might see a hit to their business next year. Some companies might not see a big benefit if they are paying a low effective tax rate now. Finally, the companies which either don’t have capital to repatriate or have already borrowed against overseas capital at low rates won’t see a benefit from the repatriation tax holiday.