Plenty To Worry About

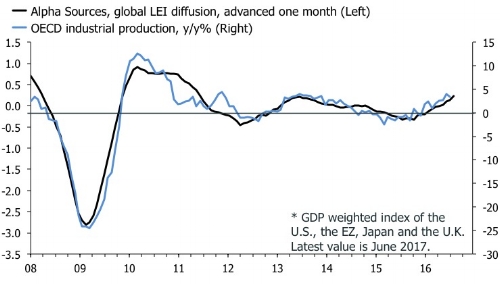

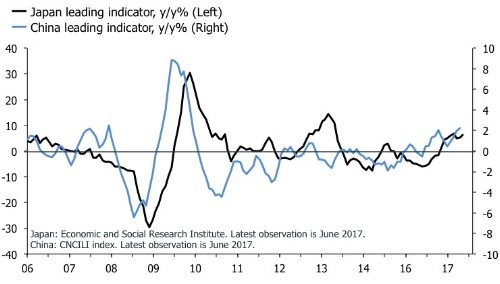

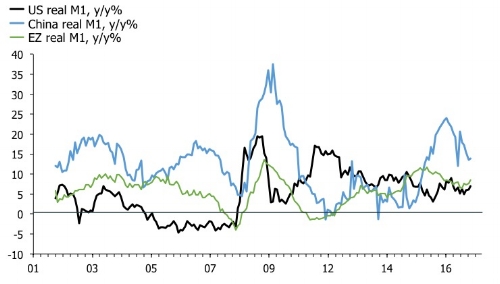

It has been three weeks since I last updated these pages, and as I leaf through my charts, I am tempted to conclude that nothing substantial has changed. In the global economy, headline leading indicators signal stable and relatively robust growth. The first chart below shows that my diffusion index of macroeconomic leading indicators is rising gently, indicating that the pace of industrial production growth in the major advanced economies will rise to slightly above 4% year-over-year in the next few months. The two following charts show individual leading indicators in the large economies. They are all rising year-over-year, and momentum has accelerated, with the notable exception of the U.K’s leading index still stuck below zero. Finally, I throw in charts of real M1 growth—arguably the best single macroeconomic leading indicator—and these data also are constructive. We have to watch the slowdown in China, but M1 growth rose in July, which does not suggest a liquidity crunch, at least not in Q3.

Except for the U.K., my reading of the major economies is that growth is more or less steady at a robust, but not record-breaking, pace. I think Simon Ward is correct in pointing to a resilient outlook for late 2017 and the beginning of next year. But he accompanies his call with a warning;

Six-month growth of global real narrow money* continued to strengthen in June, signalling a likely pick-up in economic momentum in late 2017 / early 2018, after a modest near-term slowdown. Monetary acceleration suggests that major central banks are falling further “behind the curve” and will be forced to tighten policies significantly as economic growth and inflation rebound.

I agree that we will see shifts in policy stances at the margin, but conditions will stay overall accommodative, at least in Europe and Japan. In the U.S. though, I think core inflation will rebound soon, which should re-engage the Fed and push the dollar higher. If this is right, the yield curve will retain its flattening bias. We can’t eliminate the risk of a Volcker 2.0 moment at one of the major central banks. Leadership changes are coming up, and lofty valuations mean that markets will be hyper sensitive to even small changes in communication. But I don’t think we should rush to discount this outcome without any supporting evidence. Perhaps this week’s speeches in Jackson Hole will kick up some dust, but I am not holding my breath.

But, but, geopolitics

Last week’s events show why equity investors should be careful about throwing money after strategies based on politics. U.S. equity indices struggled on Thursday as markets feared moderate forces were quitting the White House, leaving Mr. Trump at the behest of a Bannon-Navarro cocktail of craziness. But by Friday afternoon investors were left scrambling for new narratives. Steve Bannon had left the White House—but promises to be back soon—and the equity market still closed down on the day. Something was bound to happen after Mr. Trump’s handling of the Charlottesville disaster. The president should have realized that talking about “both sides” when one of these sides are sporting Confederate/KKK, and Nazi symbols is outrageous. In almost all western democracies, it would be the equivalent of political suicide; especially when this group’s protest on the day culminated in a cowardly terrorist attack killing one and injuring several others. It doesn’t matter whether the majority of the tiki-torch wielding losers are just that, losers with no real understanding of, or connection to, national socialism or the “klan”. And it certainly does not matter whether militant sentiment also exists among the counter protesters. Mr. Trump has walked away from many calamities, but this one will haunt him forever. Even Bannon distanced himself from the display of his apparent “supporters” in Charlottesville. I suspect markets won’t care about any of this until we see signs of civil war, which prompts the authorities to use force. With the risk of sounding complacent, I don’t think that is where the country is headed. Further confrontations of the kind we witnessed in Charlottesville will scar America’s soul, but we have to remember that her institutions are strong and resilient. In fact, the Trump presidency is precisely that; a test of American institutions. I think they will prevail.