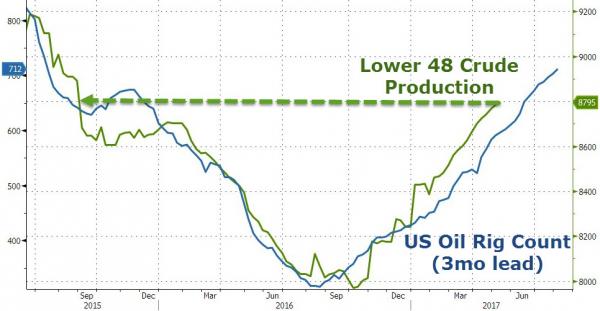

While much was made of this week’s drop in US crude production, it was driven by an Alaskan supply drop, not the Lower 48 whose production is at Aug 2015 highs. WTI back above $50 on the back of more OPEC jawboning appears to have everyone convinced this time is different, but for the 18th week in a row US oil rig counts rose (by 8 to 720).

The 18th weekly oil rig count rise…

Production from the Lower 48 continues to soar…

And WTI dipped a little on the print…

And while prices hover above $50, OilPrice.com’s Brian Noble warns that as breakeven prices converge an oil price crash nears…

No one should underestimate the impact of AI (artificial intelligence) on the future of the entire capital markets complex. The LinkedIn group, Algorithmic Traders Association, has recently been running a series of articles warning of the seismic shift that is and will continue to be felt in the global hedge fund industry as machines take over from people on trading desks.

But what intelligent human being would ever suddenly have turned bullish on the morning of Monday 15 May 2017 just because of renewed jawboning from Saudi Arabia and Russia, indulging in the same old two-step as they did at Doha in April 2016 and Vienna in November of last year. That is however precisely what the machines did. Hallelujah.

In the past couple of weeks, crude oil futures really did a round trip. First, they took a beating. WTI futures fell on May 4th to $45.52 per barrel, coming down from an April peak of $53.40, hitting the lowest point since the deal between OPEC and non-OPEC oil producers was signed last November. Since then, WTI has rallied up above $49 on as confidence grows over an OPEC cut. So is this more noise or a portent of things to come?

Despite the occasional rally, it’s hard to see that the outlook for oil is encouraging on both fundamental and technical levels. The charts look to be screaming double top for WTI, while the fundamentals seem to be saying Economics 101: too much supply, too little demand. The parallel with 2014 is there if you want to see it.