Bank of America Merrill Lynch surveys should be taken seriously. I’m not saying I agree with them always, but they usually have interesting perspectives. It’s weird how this survey usually has contrarian bets because most surveys reflect what the market is expecting. It’s possible that fund managers might acknowledge that something they are long can fall in a mean reversion. As an aside, it’s important to not get caught up in the philosophy that everything must mean revert. There should be a catalyst for the reversion. For example, you shouldn’t think stocks must fall because they are valued higher than the mean. There needs to be a catalyst for that correction.

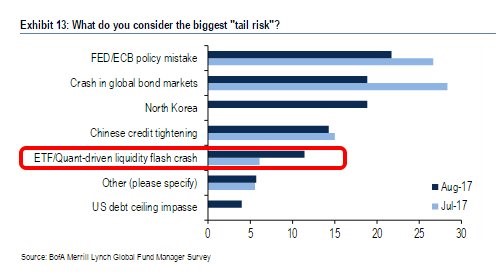

The chart below shows the biggest tail risks in July and August. A tail risk is a low probability event which could cause a market crash. On a normal distribution curve, the ends are flat. When a situation has fat tails, the chances of unlikely events increase. This definition is debated among investors because one can argue that the supposed fat tail event that was the financial crisis wasn’t a black swan. It’s not surprising that housing prices cratered because prices increased faster than they historically did and faster than population growth in the hot areas which were Florida, Arizona and California. If you did your research, like some subprime shorts did, the event was predictable. I interpret the usage of tail risk below as what can cause a correction. The only true tail risk I see in the list below is the nuclear threat of North Korea. That is a very low probability event which can be a disaster for the markets and civilization.

Not surprisingly, the North Korean threat increased since it wasn’t on the radar in July. I think in the survey next month this threat will disappear. The addition of North Korea and the debt ceiling issue pushed the other categories lower; I don’t think the chances of an ECB/Fed policy mistake fell. The debt ceiling issue will gain more focus in September as it probably won’t be solved by the next survey meaning its percentage should grow. The answer highlighted in red is the only answer which wasn’t new that increased in popularity. I don’t have expertise in the inner mechanisms of the market to determine the risk of a flash crash, but for long term investors it probably doesn’t matter. If an asset falls 10% and immediately rallies 10%, does that matter? The only thing it does is suppress valuations as some investors fear it will happen again. That could present buying opportunities.