Two months ago, when noting that hedge funds are about to underperform the market for the 7th consecutive year, we looked at the “why”: “how do hedge funds manage to underperform the broader market for 7 years in a row? Simple: by shorting all the same stocks – thereby inducing massive short squeezes when just one is forced to cover [in an illiquid market], and going long all the same strategies, such as Growth And Momentum”, known as clustering and “hedge fund hotels.”

Actually the “why” is even simpler than that: as central planning has dominated every piece of fundamental news, and as capital flows trump actual underlying data (usually in an inverse way, with negative economic news leading to surging markets), the conventional asset management game has been turned on its head. We have said this every single year for the past 7, and we are confident that as long as the Fed and central banks double as Chief Risk Officers for the market, “hedge” funds will be on an accelerated path to extinction, quite simply because in a world where a central banker’s money printer is the best and only “hedge” (for now), there is no reason to fear capital loss – after all the bigger the drop, the greater the expected central bank response according to classical Pavlovian conditioning.

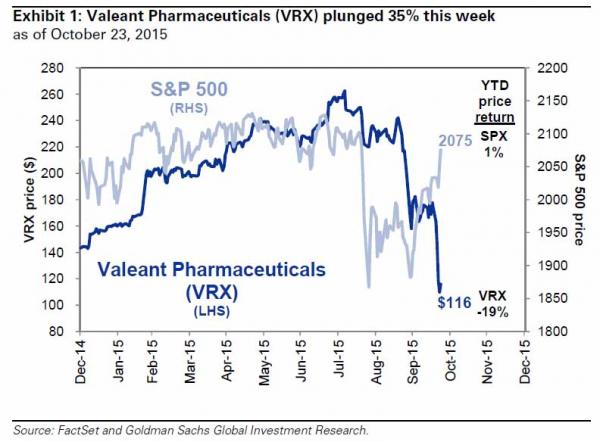

But while hedge fund upside may be capped, downside is quite unlimited in this market where levered beta works great until suddenly a hedge fund hotel, such as Valeant, blows up and wipes out dozens of “smart money” investors. Recall what Goldman said yesterday: “hedge funds own roughly 22% of Valeant’s shares, so investor sentiment and perceptions matter; our Hedge Fund Trend Monitor indicates that 7% of fundamental hedge funds own shares in VRX with 5% owning it as a top 10 position.”

All of the above should have been obvious and rather very intuitive, however hedge funds – the biggest losers from the above assessment – have understandably been eager to ignore this “New Normal” reality. Alas, as long as global central bank put is in play, it makes all of them obsolete.