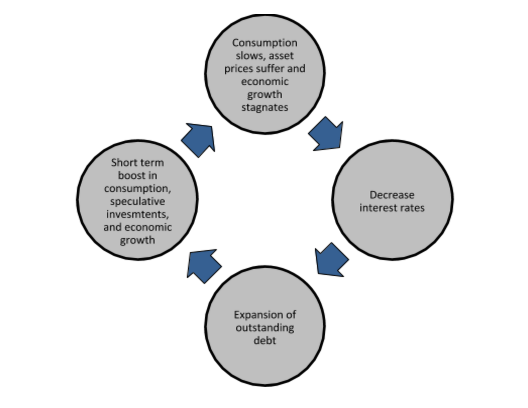

Over the past 30 years, many central banks have tried to re-order the natural drivers of economies. As opposed to savings and investment driving production and consumption, they moved consumption to the front of the line, meaning it came at the expense of savings and investment. These efforts disrupt the natural order of activities in a healthy economy and encourages an economic cycle fueled by debt. Central banks’ model, as shown below, illustrates how ever-lower interest rates are used to encourage additional borrowing to drive consumption and lift asset prices; all in the hope of ultimately achieving economic growth.

Currently economic growth in most of the largest nations is deteriorating, and once again the central bankers are grasping for remedies. However today is different than the past. Unlike prior instances of stalled growth, the central bankers’ main policy tool, interest rates, has reached a supposed limit of zero percent. To combat the situation, some central banks are employing a new tool to preserve the cycle shown above. The method to their madness is a negative interest rate policy (NIRP). This article describes a NIRP and related matters every investor should be considering. It also discusses a link between NIRP and a recent appeal of some leading economists to fight crime by eliminating large currency denominations.

A better understanding of negative rates may lead you to our opinion that the concept of a NIRP is sheer desperation akin to a last second Hail Mary pass in football, but with even lower probability of success.

Negative Interest Rates

A negative interest rate is a simple concept, yet those promoting such an economic remedy make the matter sound like a PhD dissertation and appear to be confusing the public. Before explaining what negative interest rates are, and why a central bank might promote them, we share a few headlines to highlight their developing global popularity:

Japan 2/16/2016 Reuters: “BOJ launches negative rates, already dubbed a failure by markets”

Europe 6/2014 BBC News: “ECB imposes negative interest rates”

Sweden 7/2015 Bloomberg: “Sweden deepens negative interest rates to curb gains in Krona”

Switzerland 12/2014 New York Times: “Swiss national bank to adopt a negative interest rate”

Denmark 2/2015 Wall Street Journal: “In Denmark, depositors pay interest to bank”

England 2/18/2016 Daily Mail: “Bank of England could set NEGATIVE interest rate: Move would mean that rather than earning money, savers would be charged for keeping their cash in the bank”

United States 10/2015 Market Watch: “Fed officials seem ready to deploy negative rates in next crisis”

United States 2/11/2016 CNN Money: “Janet Yellen: negative rates possible in U.S.”

When making a deposit in a bank, one is electing to forego consumption today and save money for the future. A deposit is effectively a loan to the bank that can be withdrawn at a future date without notice or penalty. Traditionally, banks pay interest on deposits to compensate for the time value of money as well as the potential default risk associated with the bank. As importantly, they also pay interest on deposits to incent people to forego consumption and allow the bank to leverage the deposit into higher yielding loans to other borrowers. This arrangement has defined banking since its earliest roots in ancient Greece nearly 4000 years ago.

Negative interest rates, however, are quite a different arrangement. They essentially ignore or negate the time value of money and any default risk associated with the entity charging negative interest rates. For example, imagine depositing $100 into your bank account only to find out that you have $98 left when you go to withdraw it in a year or two. Not only were you not compensated for the time value of money and the default risk assumed, you actually paid the bank while still assuming these risks. Equally confounding, assume you approached your mortgage banker to take out a mortgage to purchase a house and were told that you would be compensated monthly for taking such action. Welcome to the world of negative interest rates. It really is that simple; and that bizarre.