We revise our Gold short-term Elliott Wave view to a more aggressive one and call the decline to 2.8.2018 at $1306.8 ending Intermediate wave (X). For this view to get validity, however, the yellow metal needs to break above Intermediate wave (W) at $1366.06. Until then, the alternate view can’t be ruled out that the yellow metal can do a double correction in Intermediate wave (X) towards $1228.27 – $1302.28 before the rally resumes.

Up from $1306.8, the rally is expecting to be unfolding as a zigzag Elliott Wave structure where Minute wave ((a)) ended at $1361.72 and Minute wave ((b)) is expected to complete at $1320.60. Near-term, while pullbacks stay above there, and more importantly above $1306.8, expect Gold to extend higher. We don’t like selling the yellow metal. If Gold breaks below $1306.8, then the yellow metal is doing a double correction in Intermediate wave (X) and opens extension lower towards $1228.27 – $1302.28 where buyers should appear for at least a 3 waves bounce.

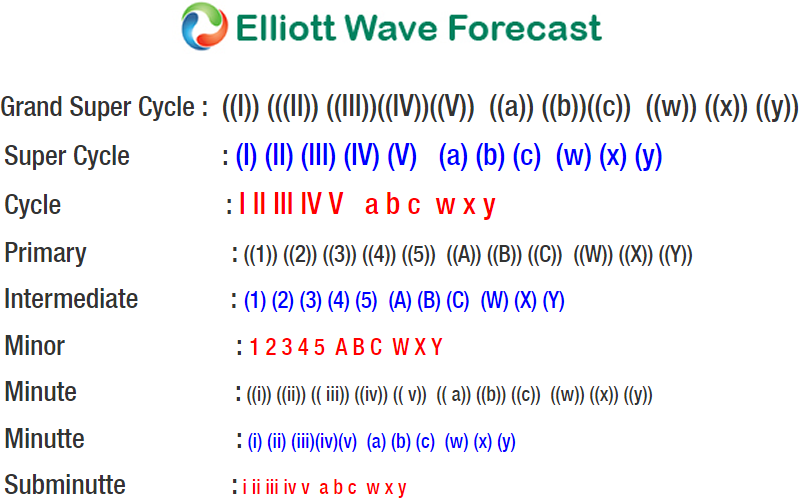

Gold 1 Hour Elliott Wave Chart