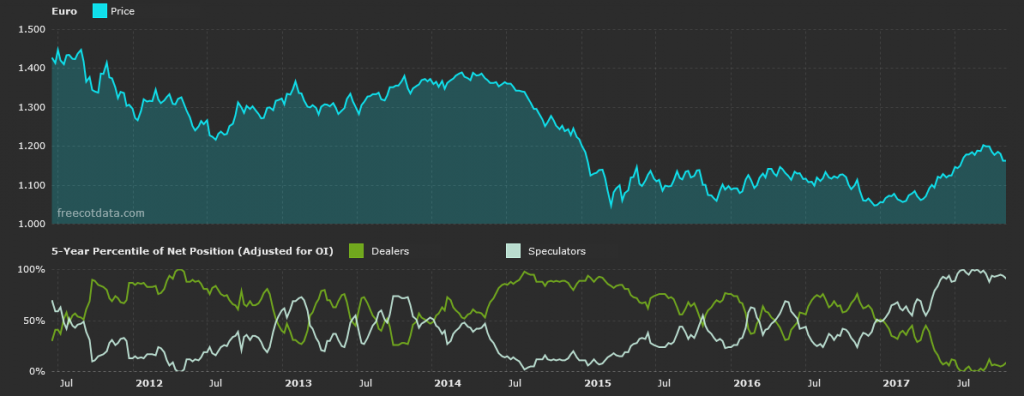

EUR/USD

Non-Commercials reduced their net long positions in the Euro last week selling 11k contracts to take the total position to 72k contracts. A resurgent US Dollar amid better US data and heightened expectations of a December rate hike has weighed on EUR sentiment following the ECB’s latest meeting which saw the market disappointed by the bank’s tapering announcement. The upcoming ECB conference this week is likely to keep downward pressure on the single currency as Draghi is expected to reiterate the bank’s commitment to maintaining accommodative monetary policy as core inflation remains subdued. On the data front, the key reading this week will be eurozone SQ GDP expected to remain unchanged both year over year and quarter over quarter.

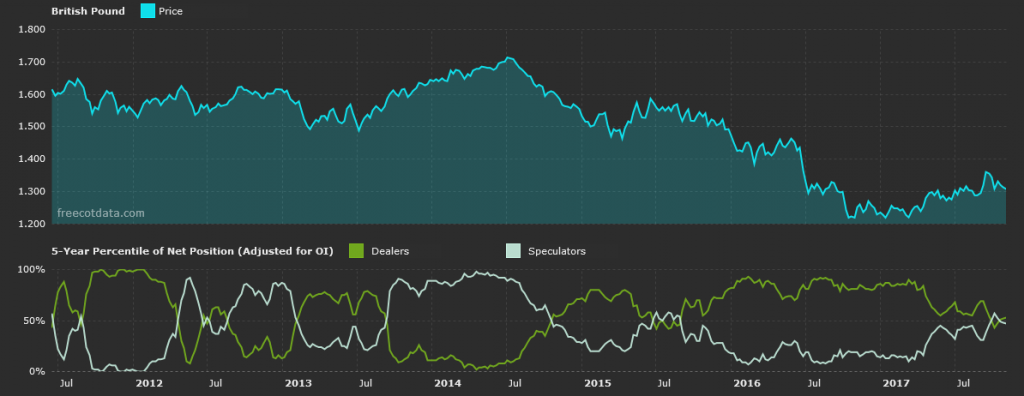

GBP/USD

Non-Commercials reversed their net short positions in Sterling last week buying 3k contracts to take the total position to 1.3k contracts. Sterling short positioning has been steadily squared over the last month as investors adjusted their exposure ahead of the November BOE meeting which, as expected, saw the bank lifting rates. The BOE expect inflation remain above target and as such the bank is expected to maintain a course of policy tightening with the market so far pricing in 0.4% worth of hikes over the next two years. Upcoming speeches by BOE’s Carney, Haldane, Broadbent & Cunliffe will be closely watched and have the potential to drive repricing on any hawkish comments. On the data front, the key reading this week will be Inflation, due on Tuesday, which is expected to have increased further over October and should again, fuel further demand for GBP.

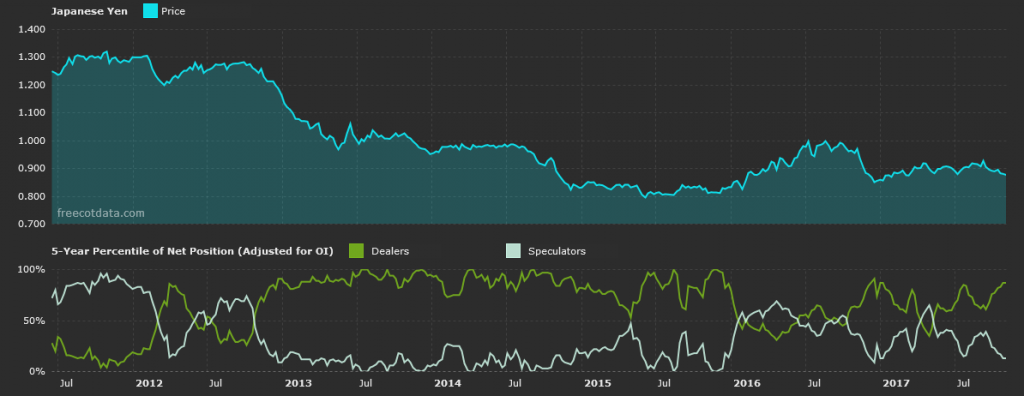

USD/JPY

Non-Commercials increased their net short positions in the Japanese Yen last week selling 2k contracts to take the total position to -119k contracts. Short positioning in the Japanese Yen continues to grow as investors speculate on the growing policy divergence between the BOJ and other central banks in the G10 space. With the ECB tapering, the BOC & BOE having raised rates and the Fed widely expected to in December, the BOJ are among the few central banks who remain committed to further easing and as such, should keep JPY pressured to the downside.