The first main event of the week, RBA (Australia) is over with the Central Bank announcing no policy change, as expected, but comments accompanying the decision, pushed the AUDUSD to 0.7280. NZD/USD also remained strongly demanded in Asia above 0.66 while the JPY fought back control versus its American counterpart, sending USD/JPY below 123.00.

Looking ahead, manufacturing data will be a major focus today. UK PMI manufacturing is expected to drop to 53.7 in November. Meanwhile, BoE will release financial stability report. Eurozone will release unemployment rate and PMI manufacturing final and Germany will release unemployment. Asian Stocks were solidly higher overnight, shrugging off the negative Chinese PMI which was the lowest reading since August 2012.

Overall USD is weaker so far, as GOLD also managed to recover, together with OIL and other commodities. Next important event is ECB on Thursday.

Trading Quote of the Day:

“Become more humble as the market goes your way.”

Green lines are resistance, Red lines are support.

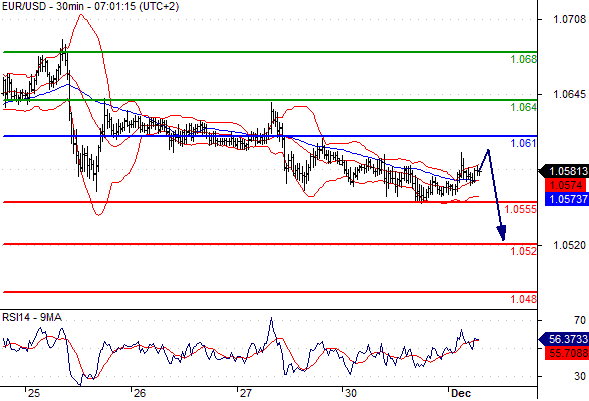

EUR/USD

Pivot: 1.061

Likely scenario: Short positions below 1.061 with targets @ 1.0555 & 1.052 in extension.

Alternative scenario: Above 1.061 look for further upside with 1.064 & 1.068 as targets.

Comment: As long as 1.061 is resistance, look for choppy price action with a bearish bias.

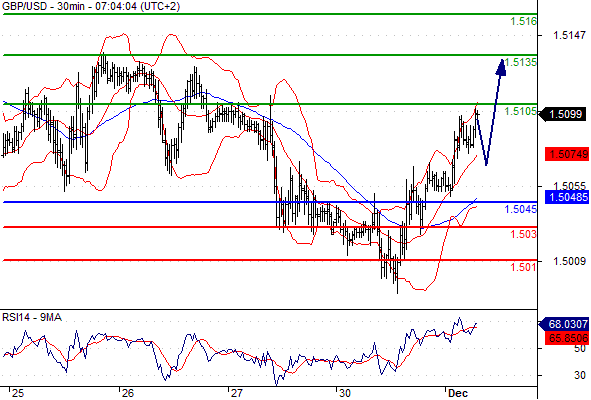

GBP/USD

Pivot: 1.5045

Likely scenario: Long positions above 1.5045 with targets @ 1.5105 & 1.5135 in extension.

Alternative scenario: Below 1.5045 look for further downside with 1.503 & 1.501 as targets.

Comment: The RSI is well directed.

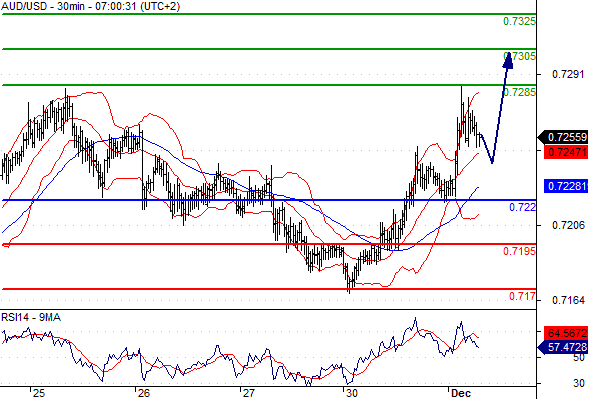

AUD/USD

Pivot: 0.722

Likely scenario: Long positions above 0.722 with targets @ 0.7285 & 0.7305 in extension.

Alternative scenario: Below 0.722 look for further downside with 0.7195 & 0.717 as targets.

Comment: The RSI is bullish and calls for further upside.

USD/JPY

Pivot: 123.1

Likely scenario: Short positions below 123.1 with targets @ 122.65 & 122.5 in extension.

Alternative scenario: Above 123.1 look for further upside with 123.35 & 123.6 as targets.

Comment: As long as the resistance at 123.1 is not surpassed, the risk of the break below 122.65 remains high.