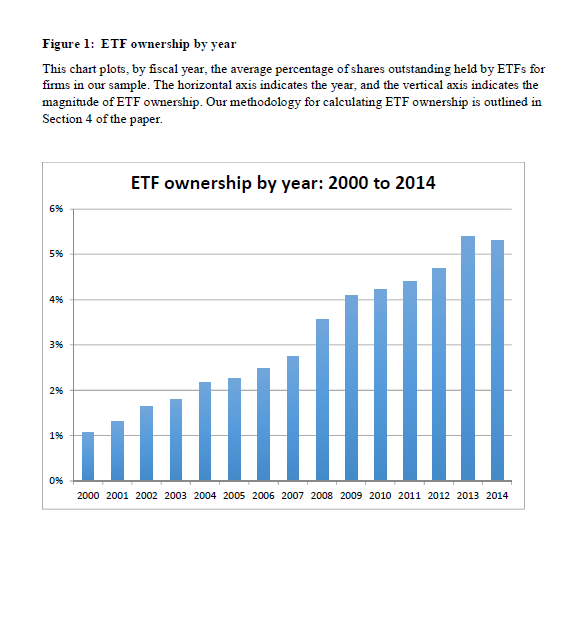

ETFs have attracted plenty of criticism over the past few years, and according to researchers at Stanford University, Emory University and the Interdisciplinary Center of Herzliya in Israel, at least some of these concerns are valid. The researchers published a paper on the topic last month within which they examined whether an increase in ETF ownership is accompanied by a decline in pricing efficiency for the underlying component securities. What they found only confirmed their initial predictions: ETFs are reducing market efficiency.

ETFs are reducing market efficiency as assets continue to climb

Specifically, the study finds that an increase in ETF ownership is associated with (1) higher trading costs (bid-ask spreads and market liquidity), (2) an increase in “stock return synchronicity,” (3) a decline in “future earnings response coefficients,” and (4) a decline in the number of analysts covering the firm.

Combined, these factors “eventually turn stocks into drones that move in lockstep with their industry” and reduces the number of opportunities for “traders seeking informational edges by offering fewer opportunities” according to Bloomberg’s analysis of the findings.

ETFs Are Reducing Market Efficiency

The researchers discovered that a single percentage point increase in ETF ownership of a stock leads to a 9% increase in correlation between the ETF and share’s industry group and the broader market. Furthermore, the relationship between a share’s price and future earnings falls 14%. The bid-ask spread also rises 1.6%, and absolute returns grow by 2%.

The paper goes on to argue that these changes occur because of the way unsophisticated investors buy securities. Indeed, ETFs have greatly improved the average investors’ access to markets and also reduced trading costs, but at the same time, they’ve also decreased the advantage Wall Street has over nonprofessional investors. Whereas before traders who thought they knew something others didn’t, could profit by outmaneuvering less informed buyers, today a large volume of stock is locked up in ETFs reducing the trader’s ability to profit. These negative impacts snowball. Fewer trades occur, so liquidity deteriorates, increasing transaction costs, which deters professional traders, impacting liquidity further and so on.