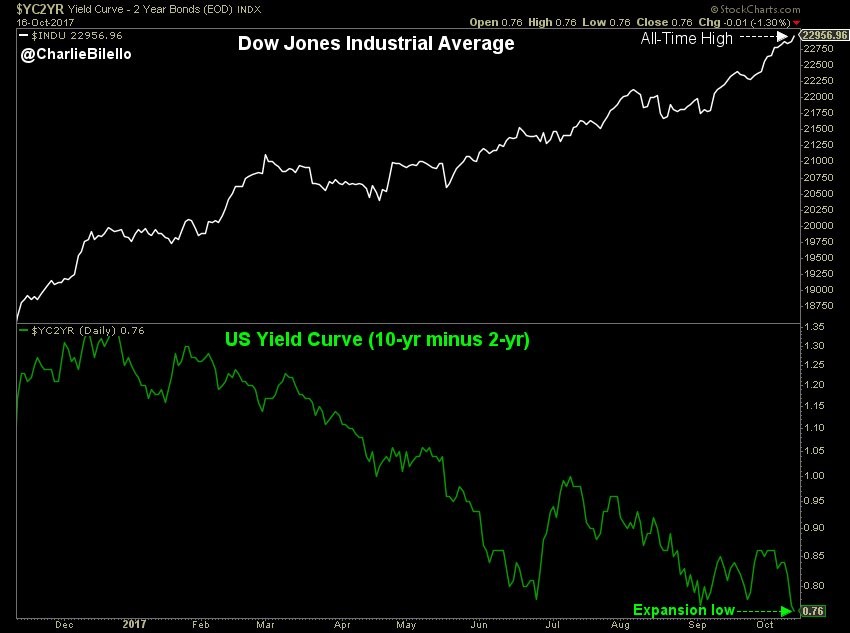

After a few months of coming close, the yield curve has finally met the flattest point since before the last recession. The difference between the 10 year and the 2-year bond yield is 76 basis points which is tied with the summer of 2016 for the lowest difference this cycle. Meeting the low could be a technical signal that sends the yield curve closer to an inversion. As of now, it doesn’t mean much. The chart below comparing the Dow to the yield curve shouldn’t cause investors any concern because recessions usually occur after the yield curve is inverted.

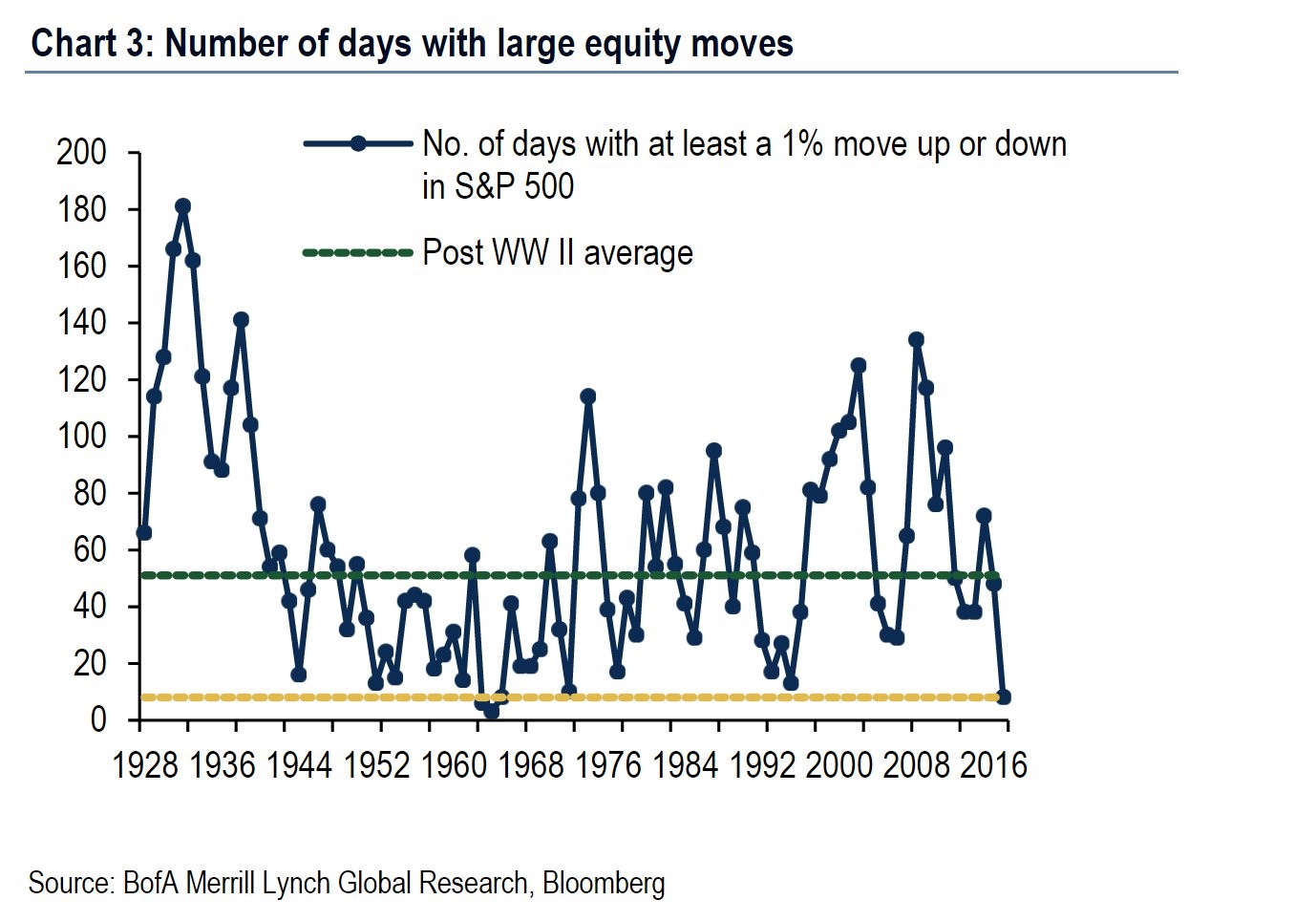

Monday was another great day for stocks as all major indexes rallied. The Dow was the best performing one as it was up 0.37%. Oddly, the VIX was up 3.12%. It still is below 10 meaning volatility is very low. If October ended today, the VIX would have the lowest average for a month ever. The chart below is another way to look at the lack of movement in stocks. It shows the number of days in the year where the S&P 500 has moved up or down 1%. This year there have been less than 10 days with a 1% move. We’ll see if central banks’ asset purchases have anything to do with the volatility suppression next year when QE is shrunk.

Before I get into the updated situation in Europe, let’s look at the Barclays’ survey about which parts of Fed meetings are the most important and which are the least important. The individual voting records aren’t considered essential because some of the voters are rotated. Most of the votes aren’t surprising because we know who is the most likely to be hawkish and who is the most likely to be dovish. Interest rate projections not being considered essential shows how the Fed has lost credibility. Long term projections are guesses based on the current information. They change often, meaning they don’t have much accuracy. The transcript of the policy meeting gives us a good overview of what the Fed changed its mind on. The press conference allows for questions to be asked which gives us clarification on ambiguous points. The Minutes are great because they tell us everything the Fed considered before making its decisions.