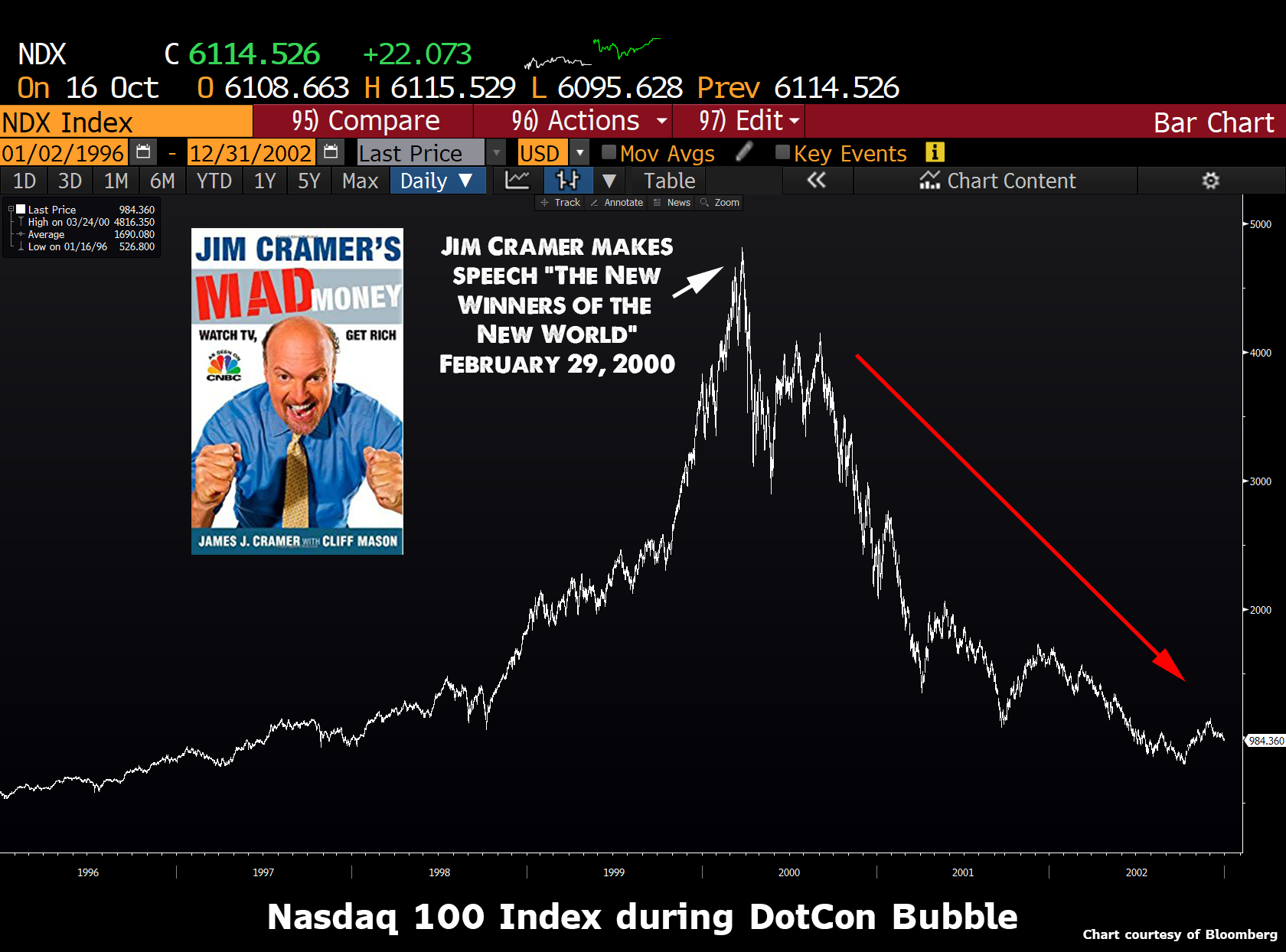

The New “Winners of the New World”

Do you remember Jim Cramer’s February 29th, 2000 speech, “Winners of the New World?

You want winners? You want me to put my Cramer Berkowitz hedge fund hat on and just discuss what my fund is buying today to try to make money tomorrow and the next day and the next? You want my top 10 stocks for who is going to make it in the New World? You know what? I am going to give them to you. Right here. Right now.

OK. Here goes. Write them down – no handouts here!: 724 Solutions ( SVNX), Ariba (ARBA), Digital Island ( ISLD), Exodus ( EXDS), InfoSpace.com ( INSP), Inktomi ( INKT), Mercury Interactive ( MERQ), Sonera ( SNRA), VeriSign ( VRSN) and Veritas Software ( VRTS).

We are buying some of every one of these this morning as I give this speech. We buy them every day, particularly if they are down, which, no surprise given what they do, is very rare. And we will keep doing so until this period is over – and it is very far from ending. Heck, people are just learning these stories on Wall Street, and the more they come to learn, the more they love and own! Most of these companies don’t even have earnings per share, so we won’t have to be constrained by that methodology for quarters to come.

We try to own every one of them. Every single one. And if I had my druthers, I wouldn’t own any other stocks in the year 2000. Because these are the only ones worth owning right now in this extremely difficult, extremely narrow stock market. They are the only ones that are going higher consistently in good days and bad. I love every one of them, just as I loathe the rest of the stock universe.

How did this stock market get like this, to where the only people who can make a dime in it are the people who are interested in the most arcane subject, the moving of data from one space to another, via strange new machines and software? How did it get to the point where nothing else matters, most particularly the 90% of the stock market I have studied for the last 20 years? How did all of that knowledge become totally irrelevant and the only stocks that work are the stocks of companies that didn’t exist five years ago and came public in the last two or three years?

So, if you can’t own the retailers, and you can’t own transports, and you can’t own banks and brokers and financials and you can’t own commodity makers and you can’t own the newspapers, and you can’t own the machinery stocks, what can you own?

A-ha, that just leaves us with tech. That’s why we keep coming back to it. That’s why, despite the 80% increase in the Nasdaq last year, we are looking at another record year now. It is by that process of elimination that I have picked my top 10. And my next 10 and my next 10 after. Only those companies are worth owning. The rest?

You can have them.

It’s easy to laugh at Cramer today. His speech was only a couple of weeks away from the all-time high in the Nasdaq, and his 10 stocks were absolute disasters.

Yet, let me assure you – in the moment, the market was gobbling up his spiel with a zeal that is tough to describe. Cramer wasn’t some raving lunatic, but a prophet who epitomized the dotcom mania. Fading the wall of buying seemed like absolute lunacy. And for the next couples of decades, I never again saw that sort of “just get me in” panic. Until now…

Before you condemn me as some sort of perma-bear who doesn’t understand the current market, please take the time to read a couple of my pieces deriding all the bearish hedge fund managers – Betting against history, It’s too easy to write bearish pieces, or Billionaire Bears Club. I have long held the belief that a stock market melt-up was just as likely as crash.

But I have a problem. I hate being in the majority. It was easy for me to speak about the possibility of a stock market spike higher when everyone was bearish. Yet the trader in me cannot stand sticking with that position in the midst of an epic squeeze.

I don’t think the market will crash (although with every passing day the froth scares me more and more.) So I am not some doomsdayer predicting some catastrophic disaster. Yet I am a trader that knows markets look best at the top.

Back to Jim Cramer’s speech at the peak of the Nasdaq madness. Yesterday one of my favourite market pundits wrote a piece that was so eerily reminiscent of Cramer’s “the inevitability of dot com stocks to levitate to the moon” fame, I had to double check the author’s credits. I think Josh Brown from Reformed Broker fame is indisputably one of the good guys, and he has correctly remained steadfastly bullish in the midst of every hedge fund hyperventilation of the coming crash. Yet I respectfully have to take the other side of Josh’s Just Own the Damn Robots piece.