Today’s Wall Street Journal shows that large-cap technology stocks are priced as if economic and earnings growth will continue for the significant future. However, this late in the cycle, the probability of a hiccup increases, making share prices vulnerable.

The article focusing on tech shares makes for uncomfortable reading even if most of the tech names are profitable, because we are seeing valuation extremes in technology only surpassed by the tech bubble. And that suggests, given the heavy weight of technology shares in major indices, investors leveraged to passive investment strategies are de facto leveraged to tech.

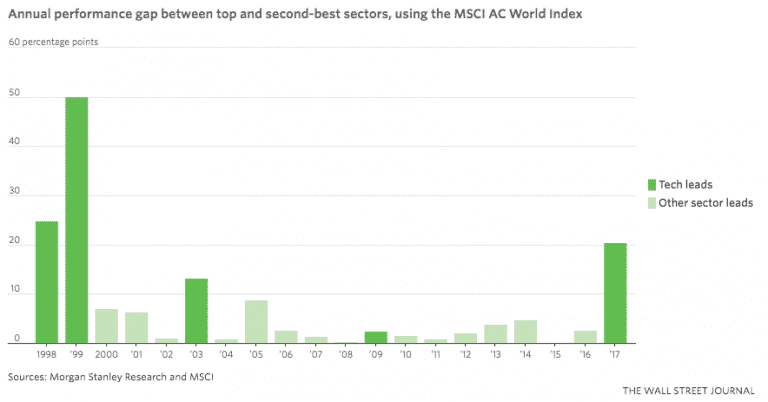

Shares in technology companies are outpacing other sectors this year by the widest margin since the height of the dot-com era, with a handful of key players dictating how markets are performing around the world.

Just eight companies—Facebook Inc., Apple Inc., Amazon.com Inc., Netflix Inc., Alphabet Inc., Baidu Inc., Alibaba Group Holding and Tencent Holdings Ltd.—have increased by $1.4 trillion in market cap in 2017, a sum roughly equivalent to the combined annual GDP of Spain and Portugal.

As the tech sector has become bigger and more influential within global stock indexes, its ascent has helped take U.S. and Asian emerging stock markets to record highs—but left behind the less tech-heavy bourses of Europe, Canada and Australia.

“There’s no doubt the markets that have high tech components will have been the best performers this year,” said Paul Markham, a global equities portfolio manager at Newton Investment Management, who has invested in many of the tech behemoths. “The narrow nature of this rally has to be seen as something of a concern…but these are cash-generative companies who are being seen as the bedrock of the new economy.”

I don’t buy this last statement. Yes, most of these companies are generating cash. But not only are the valuation gains are astronomical, you have companies like Netflix and Tesla, which are burning cash and still a part of the tech investment boom. And let’s remember that Amazon, with a market cap over $500 billion, trades at a P/E ratio of almost 300x earnings. A monster portion of Amazon’s capex will have to turn out to be for growth only, and fall to the bottom line once growth slows, to justify that multiple.