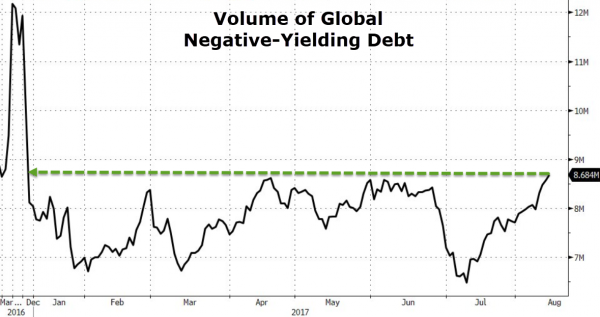

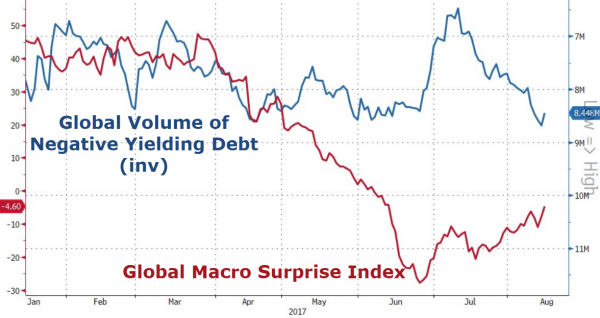

The market value of bonds yielding less than zero percent has jumped by a quarter over the past month to $8.68 trillion, the highest since October… which is odd given the mainstream narrative that everything is awesome and global growth is heading for escape velocity?

“probably nothing”

As Bloomberg notes, slower-than-forecast inflation data and haven demand on geopolitical risk have revived bond bulls around the world.

With global borrowing costs already so low, central banks should be prepared to cut interest rates deep into negative territory in the next economic downturn, warn economists including Harvard professor Kenneth Rogoff.