Most people believe the Fed can print money. Caught on tape, former Fed chair Ben Bernanke once admitted the Fed prints money.

However, in Hoisington’s Third Quarter 2015 Review, economist Lacy Hunt makes the claim the Fed cannot print money. Let’s take a look, emphasis mine.

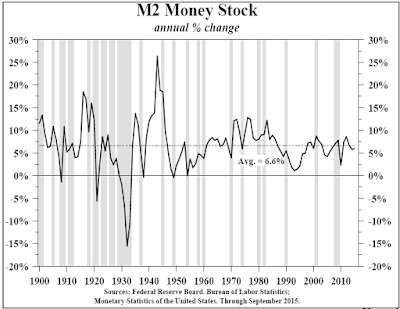

Despite the unprecedented increase in the Federal Reserve’s balance sheet, growth in M2 over the first nine months of this year fell below its average rate of growth over the past 115 years, a time when the growth in the monetary base was stable and quite modest.

In addition, velocity of money, which is an equal partner to money in determining nominal GDP, has moved even further outside the Fed’s control. The drop in velocity to a six decade low is consistent with a misallocation of capital and an increase in debt used for either unproductive or counterproductive purposes.

The evidence speaks for itself: the Fed cannot print money. The Fed does not have the authority or the mechanism to print money. They have not, they are not and they will not print money under present laws.

The Fed, of course, has the authority to buy certain assets, including government bonds, in the open market, but that is where their authority starts and stops. They create excess reserves by buying securities in the open market, which are then owned by the depository institutions. However, the Fed does not have the direct capability to move these funds and therefore place them in the hands of households, businesses, and other nonbank sectors. It is this transaction that creates money. Keeping short-term interest rates low for an extended period of time will not change the trajectory of the economic growth path as long as the massive debt overhang persists.

Ben Bernanke Says the Fed Prints Money

In Ben Bernanke’s first infomercial on 60 Minutes in March of 2009, interviewer Pelley asked Bernanke point blank: “You’ve been printing money?“

Bernanke replied “Well, effectively. And we need to do that, because our economy is very weak and inflation is very low. when the economy begins to recover, that will be the time that we need to unwind those programs, raise interest rates, reduce the money supply, and make sure that we have a recovery that does not involve inflation.“

Ben Bernanke Denies the Fed Prints Money

In a second 60 Minutes Fed infomercial in December of 2010 Bernanke made this claim: “One myth that’s out there is that what we’re doing is printing money. We’re not printing money. The amount of currency in circulation is not changing.“

This admission, and denial, is one of the funniest things the Daily Show covered. Please play the following video for a big laugh.