Mali’s gold exports are falling, and new discoveries aren’t enough to make up for the loss of its giant legacy mines, where production is already dead or winding down, and the fate of one of the biggest of them all—Sadiola—now hangs in the balance.

The world-class Sadiola gold mine needs an investment of $380 million to keep it open for another 10 years, accessing 3.4 million ounces in reserves.

But there are signals that negotiations over the deal to extend the productive life of Sadiola by at least another decade have stalled within the government, putting the investment at risk.

The reason for the stalled negotiations remain unclear, but what’s at stake for Mali is as visible as ever: Sadiola is crucial for Mali’s reputation as one of Africa’s top three gold producers. Next to this, it is a crucial lifeline for new jobs and much-needed state revenues.

How the stalled negotiations over Sadiola are resolved could be a litmus test for a government heading into elections next year—and a government that relies heavily on foreign aid, while working hard to create an attractive investment climate.

The investment climate in theory has improved immensely in recent years, but putting this into practice has proved to be challenging in this terrain.

So far, it’s been moving in the right direction. But many industry eyes will be on the Sadiola deal ahead of the Invest in Mali Forum 2017, which will be held in Bamako in early Decemberand supported by the World Bank.

Sadiola—A Legacy with a Lot More Gold to Give

The Sadiola mine is a joint venture between Canadian miner IAMGOLD (NYSE:IAG) (TSX:IMG) with 41 percent, operator AngloGold Ashanti (NYSE:AU) with 41 percent, and the Government of Mali with 18 percent.

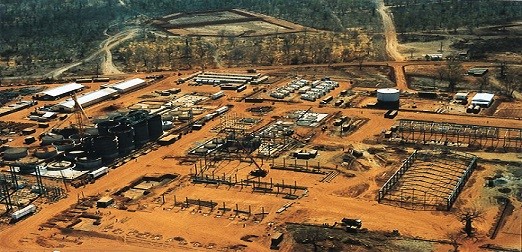

Located in southwest Mali near the border with Senegal in a remote part of the Kayes region, the giant Sadiola permit covers 302 square kilometers.

The existing plant was built to process soft rock, or oxides, and the soft rock is now running out. But Sadiola has much more to give with the massive hard-rock, or sulphides, deposit that lies beneath the depleted oxides. This is now a ‘hard rock’ story, and IAMGOLD and AngloGold Ashanti are keen to invest in a major plant modification that would enable hard-rock processing.