(Photo Credit: Kristen Cavanaugh)

Quarterly reports for the major banks are set to start releasing results this week, and there are some positives to take away for the upcoming earnings season.

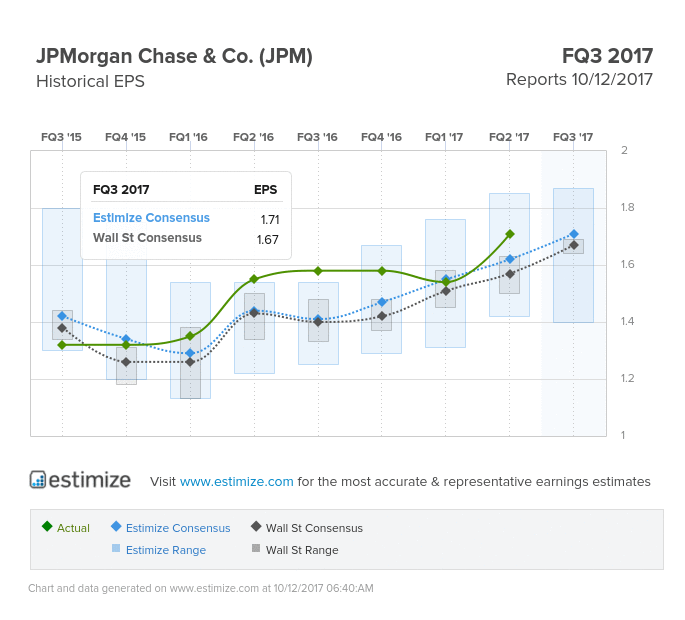

JPMorgan & Chase Co – Financials – Diversified Financial Services | Reports October 12, BMO

Despite the stagnancy last year, things are starting to look upwards for J.P. Morgan. This quarter, Estimize predicts EPS to be $1.71 and the Street predicts EPS at $1.67, with an overall projected year-on-year growth rate at 8%. The bank also tends to outperform the EPS predictions, beating Estimize and Wall Street 67% and 77% of the time, respectively.

And one can understand why. Last week, the FDIC released a report showing how J.P. Morgan has led American banks in total deposits for the first time in 23 years, edging out Bank of America Merrill Lynch. This news comes as a huge win for J. P. Morgan, expectedly so after seeing significant deposit growth over the past 5 years. In the last quarter, the bank has also made strides to expanding their network through horizontal integration, a notable example being their investment into Bill.com. The move has made ripples through the B2B payments market, which up until now, has been crawling towards digitalization.

However, FICC Trading Revenue seems to have taken a particular hit, and this is a reality that does not only ring true for JPM. Trading revenues have been low for all banks across this quarter, with Estimize predicting a YoY growth for JPM trading revenues to fall by around 20%.

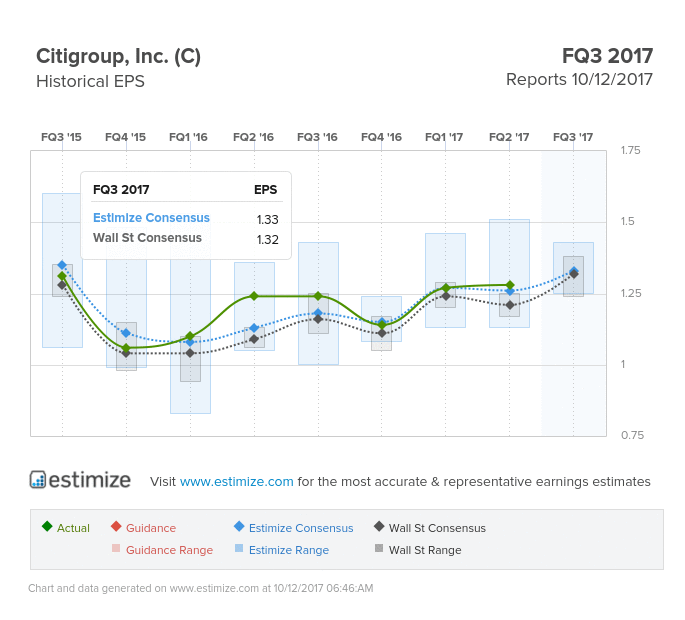

Citigroup – Financials – Diversified Financial Services | Reports October 12, BMO

Joining the likes of J.P. Morgan and Bank of America, Citigroup too seems to be looking at a decent YoY growth rate for EPS, with Estimize predictions at approximately 7%. The bank is expecting EPS values of $1.33 and $1.32 according to Estimize and the Street respectively.

Whilst Investment Banking and Equities Trading revenues may be projected to grow this quarter, Citigroup – like its competitors – seems to have taken a knock in FICC Trading revenues. At an investor conference mid-September, CEO John Gerspach said he was expecting around a 15% fall in total trading revenues.