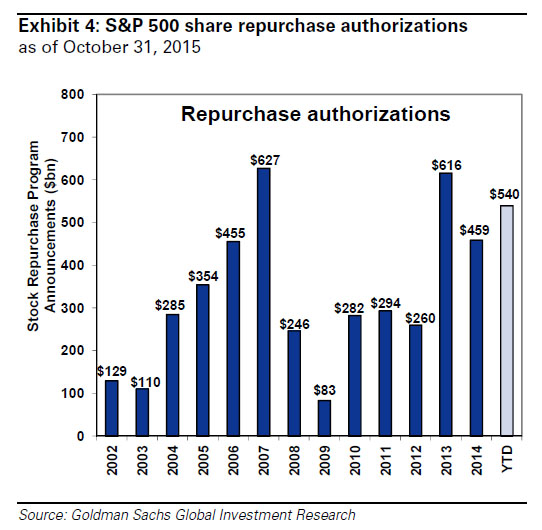

If you said just more of the same, with corporate management teams buying back their own stock in near record quantities (boosting their own stock-linked compensation in the process) and serving as the biggest marginal buyer in the market, then give yourself a pat on the back.

Here is Goldman’s David Kostin confirming just that.

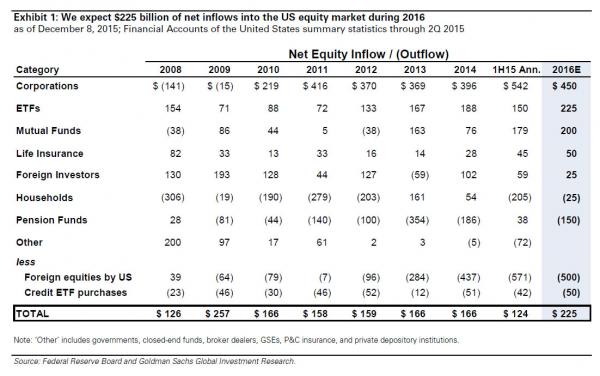

We expect corporations will continue to be the largest source of demand for stocks, with net purchases by US companies totaling $450 billion, equal to about 2% of public equity cap. We forecast equity inflows from equity-related ETFs ($225 billion), equity mutual funds ($200 billion), life insurance ($50 billion), and foreign investors ($25 billion). We forecast net outflows from households ($25 billion) and pensions ($150 billion).

Goldman forecasts $225 billion of aggregate net demand for US equities in 2016. Goldman also calculates that its estimate of gross equity demand of $775 billion will be reduced by $500 billion of international equity purchases by US investors and $50 billion of credit investments resulting in net demand for domestic stocks of $225 billion.

Some more details:

Corporations will be the largest source of equity demand next year, purchasing $450 billion of US equity through buybacks and cash M&A (net of share issuance). Outside of the Great Recession, corporates have been the primary source of US equity demand (see Exhibit 1). We expect this trend will continue as managements direct cash toward share repurchases and M&A during 2016 given low (albeit increasing) interest rates, modest GDP growth, and a flat domestic equity market. For details on our 2016 cash use forecasts see S&P 500 cash spending trends: Investing vs. returning capital (November 6, 2015).

Exhibit 1 highlights the equity inflows and outflows from each holder within the US market. Exhibits 2 and 3 show the supply and demand of US equities. For example, if a company repurchases shares it reduces the supply of US equities (Exhibits 2 and 3) but it would appear as a positive inflow into US equities (Exhibit 1) given that a US stock is being purchased. ETFs are both equity issuers and holders. Our 2016 total net US equity flow forecast of $225 billion excludes US investor purchases of foreign equities. However, we include foreign stocks in our net issuance tables as US investor purchases of foreign stocks alter the supply of equities within the US market.