To start this discussion, let me put it out there that I tend to be more skeptical of companies that pay monthly dividends. After reviewing many monthly pay stocks, I have found that management teams like to use the monthly dividend hook as a smoke screen for subpar financial results. An attractive yield combined with monthly dividend payments can cause investors to focus on those two facts and not look seriously into the company financials. My skepticism of the monthly dividend scheme forces me to dig even deeper when I look at a monthly paying stock for analysis. When I do find one worth buying, I am extra pleased to recommend it to my newsletter subscribers.

Below are several examples of monthly pay stocks that should provide attractive yields in your portfolio. Not all of them are recommendations for The Dividend Hunter subscribers, but they have merits that make them stand out from the monthly dividend stocks pack.

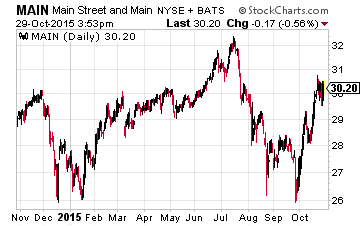

Main Street Capital Corporation (NYSE:MAIN) may be the best monthly dividend stock in the market. This business development company (BDC) has figured out how to stand apart from the pack in the face of the restrictive BDC rules. Witness these dividend stats about MAIN:

MAIN currently yields 7.1%.

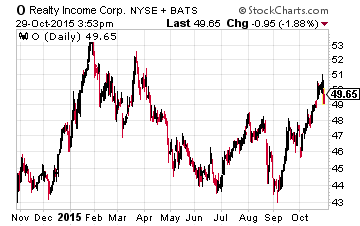

Realty Income Corp (NYSE:O) has trademarked its “The Monthly Income Company” descriptor. Realty Income is a net lease REIT, probably the most stable of the different REIT categories. This is one of the larger REITs with a $12 billion market cap. The company has an unparalleled dividend record, having paid a dividend for 540 consecutive months with 81 dividend rate increases since 1994. That works out to an increase almost every quarter. Both the Realty Income yield and annual dividend growth rate are about 4.5%. With Realty Income you are not investing to maximize income, but to generate a very safe monthly income with a yield that is still very attractive compared to most other income investments.